The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

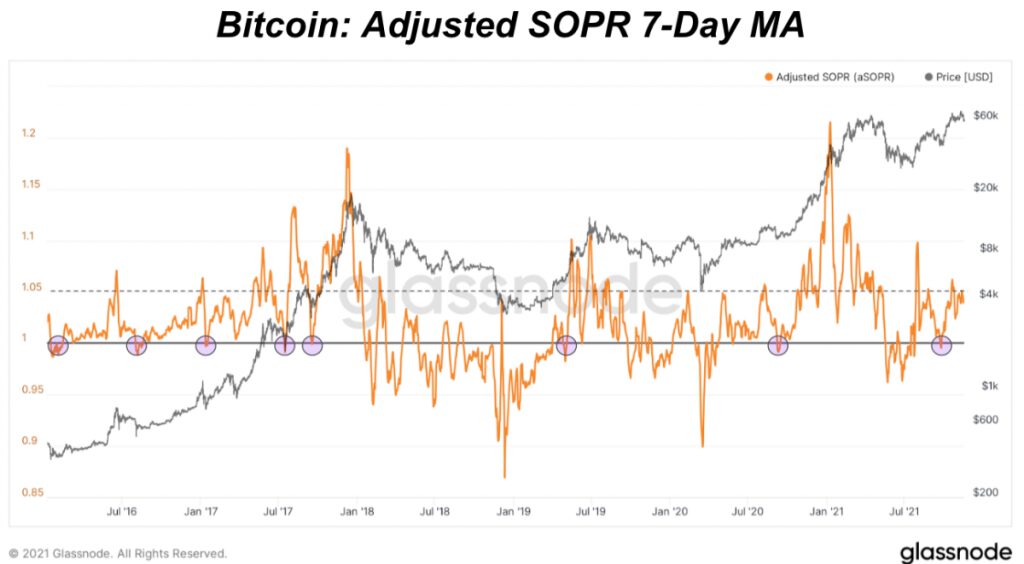

A key indicator to track on-chain spending behavior and current market sentiment is the Spent Output Profit Ratio (SOPR). SOPR is calculated by dividing the realized value of a spent output (in USD) by the value at creation of the original. Simply put, it’s calculating the price sold over price paid for every UTXO that moves on-chain. The best place to read more on SOPR is here.

SOPR values greater than 1 indicate that on average, more profit is being realized while SOPR values less than 1 indicate that on average, more losses are being realized. At a value of 1, the market is net neutral. We can analyze SOPR behavior at a total market level and across long-term holders (LTHs) and short-term holders (STHs).

What to look for in the SOPR metric is the metric’s reaction around 1. During continued bull-cycle rallies, we consistently see more profit-taking behavior under 5% with these in-between periods when the market is neutral or break-even. You can see when SOPR bounces off of 1 and back to a state of profit taking during bull markets. When it falls below 1 and doesn’t reclaim that level, the market is signaling a bull market reversal forming as investors realize more losses, expecting price to go lower. Here, we use the Adjusted SOPR which ignores all outputs with a lifespan of less than one hour.

As we approach the tops of bull cycles, there are typically sustained, elevated levels of profit taking right before higher peaks. Eventually, the spent supply overwhelms new demand, and therefore a top forms. Currently, we’re seeing increased profit taking but not at the level of a cycle top or peak.

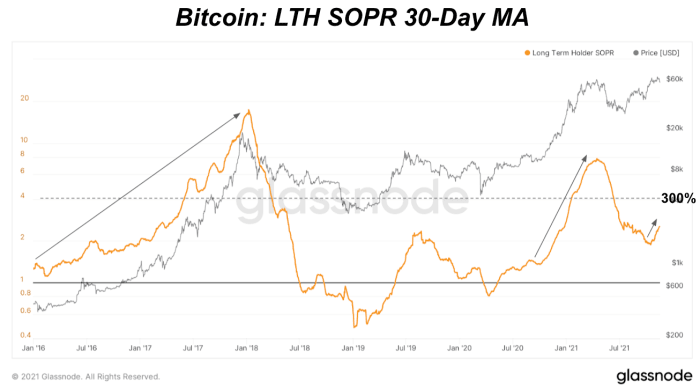

In previous cycles, there’s a rising trend of long-term holders realizing increased profits as price is bid up by new market entrants. Using a 30-day moving average to take a more macro view of the market, we look to have just started this increased trend of LTH profit taking. Profit taking is a healthy sign indicating the second stage of the bull market, distribution over accumulation, is beginning.

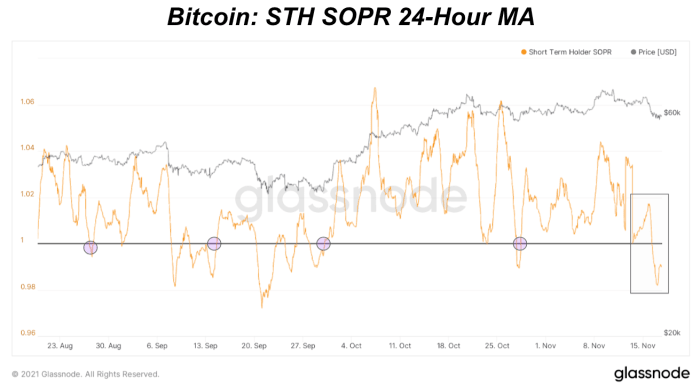

For short-term holders, there is a consistent trend of behavior during corrections in bull cycles. As price corrects, weaker hands capitulate and realize losses which puts more sell pressure on the market. We typically see the STH SOPR number reclaim a position back over 1 after this event, as new buyers are shaken out. Not reclaiming 1 would signal that the larger market of short-term holders are not willing to hold coins and rather want to sell them at a loss. For bull market cycles to continue, we’re looking to see the latest STH SOPR reclaim back over 1 when using the 24-hour MA chart. It’s already showing signs of doing so: