- Hubble, one of the DeFi solutions on Solana, enhances the way users earn.

- Users can take out a loan in USDH and invest the funds in other yield farming protocols for stablecoins.

- Hubble supports yield-bearing collateral and delegates “vanilla” SOL to yield staking protocols.

The cryptocurrency industry spans multiple blockchains and networks to help users earn interest. Using one’s existing crypto assets to make more money is a popular option, and there are many different opportunities to explore. But, more importantly, it highlights the importance of decentralized finance.

Cryptocurrency Staking Remains Popular

One of the most straightforward ways of earning interest on your crypto assets is by staking them. More specifically, several networks and blockchains support the proof-of-stake mechanism that lets users lock up their funds in a wallet to help validate network transactions. Users will receive new network tokens while doing so, although the issuance rates will vary from one network to the next. The industry average is just over 19% for PoS coins today, with projects like Axie Infinity (81.07%) and LooksRare (1,100%) offering far higher annual rewards.

It is also worth noting different networks have various requirements for locking up funds. For instance, becoming an Ethereum staker requires a much more extended lockup period. On the other hand, other currencies may let users stake and unstake at any time.

Options to explore beyond Ethereum (4.06%) include Terra (8.03%), Cardano (5.02%), Tezos (5.52%), Solana (5.89%), and many others. Always conduct thorough research on the staking rewards and requirements before making any financial commitments. Moreover, those who engage in staking need patience and find a long-term reason to support that particular network. It is not a get-rich-quick scheme.

Additionally, most exchanges will let users stake supported currencies. A viable option, but users will always pay a fee and have to rely on the “goodwill” of the exchange to be honest about the rewards they give to you. It is not in their best interest to cheat users, but that is something to consider at all times.

Crypto Savings Accounts

The cryptocurrency industry has created some intriguing interest-earning vehicles. For example, Crypto savings accounts are somewhat similar to a bank’s savings account, as users earn interest in exchange for contributing crypto assets. Funds are held by a centralized entity and are used to pay lenders who will return the funds over time plus interest.

Like staking on a crypto exchange, most crypto savings accounts require you to give up control over your funds. Although you can usually withdraw funds at any time, relinquishing that control remains tricky. However, crypto savings accounts often support currencies that have no native staking support, like Bitcoin, XRP, stablecoins, etc.

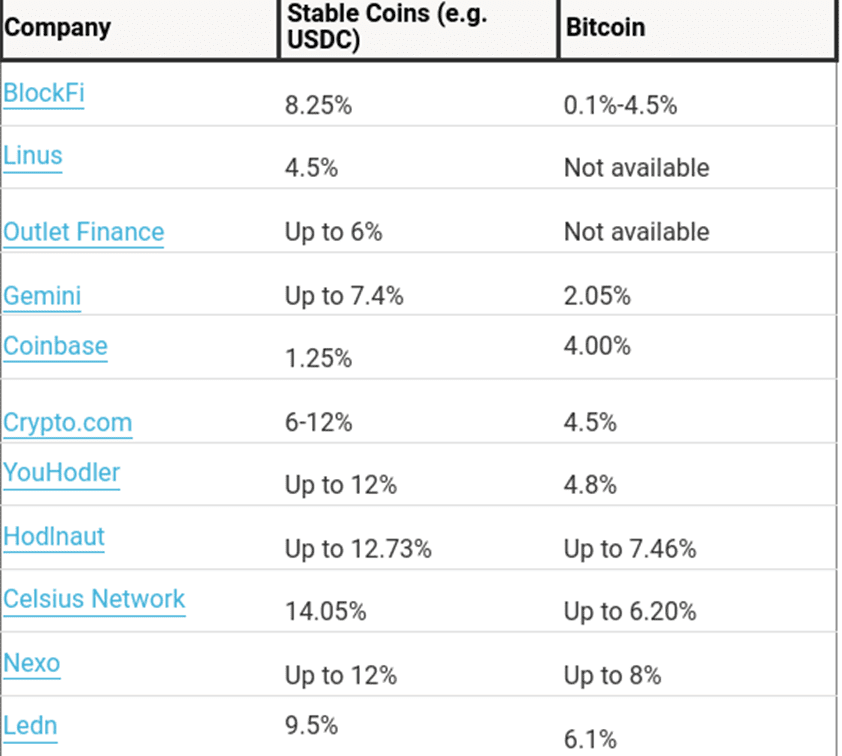

You can access crypto savings accounts through various service providers, including prominent crypto exchanges. Every platform will have different interest rates and fees associated with providing this service. Thorough research is needed to find the right provider and don’t ignore the risks.

DeFi and Yield Farming

One of the more prominent trends to earn interest with crypto is decentralized finance and its yield farming option. While it is more complex than the other options, it provides more competitive rates. The DeFi platforms allow users to lock up holdings in a smart contract to earn interest. Locked funds can be used for lending, staking, liquidity, farming, and much more.

Numerous blockchains have successful DeFi projects and ventures today. Ethereum, Fantom, Terra, Avalanche, and other networks compete for their share of the proverbial pie. Some projects even exist across multiple networks to attract more users, improve liquidity, and enhance the interest offered to users.

One emerging network in DeFi is Solana, an efficient blockchain with high throughput. Hubble, one of the DeFi solutions on Solana (SOL), enhances the way users earn interest on their crypto assets. Users can take out a loan in USDH – a stablecoin backed by a basket of crypto assets, including SOL, BTC, ETH, RAY, SRM, and FTT – and invest the funds in other yield farming protocols for stablecoins. Afterward, users can pay back the borrowed funds to retrieve their initial collateral and keep the profits earned from yield farming.

More importantly, Hubble supports yield-bearing collateral and delegates “vanilla” SOL to yield staking protocols. There’s also support for Bitcoin and Ethereum, which are delegated to partner lending platforms to earn more interest. The multi-asset collateral approach elevates Hubble above competing solutions, and the protocol does not take a cut from the yield earned by its users.

For yield farming, achieving a high APY is all that matters to most users. Pancakeswap is the go-to platform, per the data by Coinmarketcap as seen below. Rates of over 130% daily are not uncommon, although these numbers may fluctuate wildly.

Closing Thoughts

There are still many ways for users to earn interest with crypto. Whether it is staking, a crypto savings account, or DeFi opportunities, everyone can access these products and services without requiring approval from a third party. Finding the right solution that suits your needs will require some research and comparison, and new and better opportunities pop up regularly.

The approach by Hubble on Solana shows how a hands-off approach can generate multiple revenue streams for users. But, more importantly, the user doesn’t have to worry about anything after they deposit funds, as they earn interest with crypto passively. Moreover, the use of a stablecoin is low-risk compared to more volatile crypto assets, lowering the barriers to the adoption of DeFi solutions.