Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

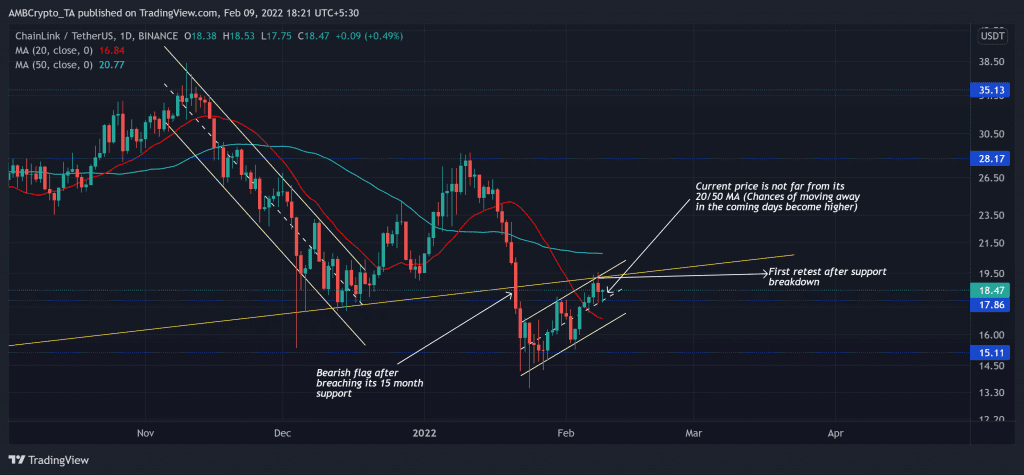

Since striking its ATH on 10 May, Chainlink (LINK) bears made a point to mark lower peaks while testing its 15-month trendline support (Now resistance, yellow) over the past nine months. The most recent fall pushed LINK below the above support while marking a bearish flag on its daily chart. At press time, LINK traded at $18.47.

A convincing close below the $17.8-mark would boost the chances of a likely breakdown. Should the 9 February candlestick close as green, it would represent a classic bullish Pinbar that could propel a retest of the upper trendline near the $20-level.

The most recent sell-off (from 11 January) led the alt to lose more than half its value and plunge toward its six-month low on 24 January. As the $15.11-level support has historically (for over a year) served as a strong buying zone, LINK reversed to form an up-channel on its daily chart.

While the bearish flag plunged below the 15-month-long support (now resistance), the current price was still not overstretched from its 20 SMA (red) and 50 SMA (cyan). Thus, increasing the chances of high volatility in the days to come. Also, the price saw its first retest after breaking down from the support. But it still needed to mark lower peaks and troughs to confirm that it is not a false breakdown.

So, a fall below $17.8 undeniably would be a crucial confluence to reaffirm the bearish tendencies of LINK. A close watch on the 9 February candlestick would be vital to determine a possible retest of the upper trendline. Considering the sustained bullish pressure in the last week, one cannot discard the possibility of a false breakdown.

Rationale

The RSI saw a revival from the oversold region but struggled to claim a bullish edge while facing resistance at the half-line. Any close above equilibrium would likely result in a retest of the $20-mark.

While the DMI lines finally saw a bullish crossover, the ADX was on a steep downtrend. Hence, the chances of keeping the 15-month resistance (yellow) intact were still bright.

Conclusion

The next few days are vital to confirm a trend reversal. The alt would most likely test the upper trendline of the channel before testing its 20 SMA. Any close outside the channel would be a solid indication of the upcoming trend.

Even so, an overall market sentiment analysis becomes vital to complement the technical factors to make a profitable move.