- Support for the conversion of the Grayscale Bitcoin Trust into a spot ETF has been immense from U.S investors as the SEC opened up for public feedback.

- Some say the watchdog is protecting the rich at the expense of retail traders while others questioned why the regulator approved a futures ETF and not a spot ETF.

The U.S Securities and Exchange Commission has been adamant against a Bitcoin spot ETF, but if public feedback is anything to go by, American investors don’t agree with the watchdog. Support for the conversion of the Grayscale Bitcoin Trust into a spot ETF has been immense from U.S investors after the SEC started collecting feedback on Grayscale’s application.

As CNF has reported over the past five months, Grayscale has been pursuing a spot ETF licensing by the SEC since October. The regulator has delayed its decision since then and in its latest move, it has started collecting public feedback over whether it should approve the application.

Great question.

If you’re interested in sharing your thoughts with the SEC on whether $GBTC should be allowed to convert into an ETF, visit this link and click “Submit Comments on SR-NYSEArca-2021-90” https://t.co/JGsvclzRy1 https://t.co/NsujcPrt1K pic.twitter.com/IHYZcPvJw2

— Grayscale (@Grayscale) February 10, 2022

Grayscale is the world’s largest cryptocurrency investment manager. Its investment products, spanning BTC and a raft of altcoins – from Ethereum and Solana to Zcash, Litecoin and Filecoin – hold about $38 billion today, with about 75% of it being held in its Bitcoin Trust (GBTC).

It’s this GBTC Trust that the company has been seeking to convert into a spot ETF. Spot ETFs are backed by physical Bitcoin as opposed to futures ETFs which are backed by futures contracts.

Read More: Grayscale says SEC broke the law by rejecting Bitcoin spot ETF applications

Investors support the Grayscale Bitcoin spot ETF application, call the SEC out

The spot ETF application received an outpour of support from investors, with Bloomberg senior ETF analyst Eric Balchunas stating that 95 percent of the feedback to the SEC was in support of the application.

Just glancing through the many comments from ppl to the SEC re converting $GBTC to an ETF and 95% are in favor of it and most using real names and pointing to the stupefying fact that futures ETF ok but spot not. eg: pic.twitter.com/j15iNYnh8R

— Eric Balchunas (@EricBalchunas) February 14, 2022

One investor called the SEC out for not approving the spot ETF despite already approving a futures ETF.

“The US is already behind other countries like Canada in the approval of a spot Bitcoin ETF and is being left behind. We need to stay competitive or risk losing investments abroad,” the investor stated.

For another, his support was more personal, claiming he had invested his entire life savings into the GBTC Trust. Approving the spot ETF would ensure that his investment was in actual BTC, not futures contracts, he said.

“I’m tired of the SEC protecting people. You just want to help the rich and give them access first. Please listen to the retail persons and make GBTC pegged to real BTC,” he implored the SEC.

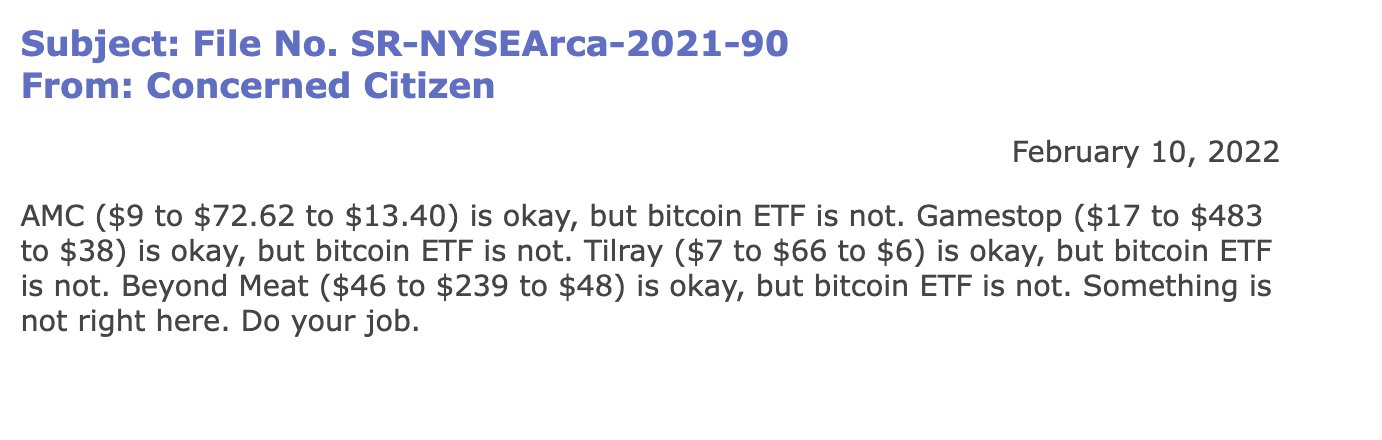

And then there are those who called the SEC out on its hypocrisy in saying that BTC is highly prone to manipulation when investors have been toying with GameStop and AMC stocks for fun in the past year.

The support was from within the crypto circles as well. Coinbase was one of those that expressed its support for the spot ETF application. This is quite significant, given that if it was approved, the ETF would be in direct competition to Coinbase products. “If one of us grows, we all grow,” seems to be the mantra that Brian Armstrong is employing with Coinbase.