On-chain data shows the Ethereum netflows are sharply turning positive, a sign that could prove to be bearish for the crypto.

Ethereum Exchange Reserve Rises As Netflows Become Positive

As pointed out by an analyst in a CryptoQuant post, exchanges have observed net ETH inflows recently, swelling up their reserves.

The “all exchanges netflow” is an indicator that measures the net amount of Ethereum moving into or out of wallets of all exchanges. The metric’s value is calculated by taking the difference between the inflows and the outflows.

When the value of the indicator is positive, it means exchanges are getting more inflows right now than outflows. Such a trend can be bearish for the price of the coin as investors usually deposit their ETH to exchanges for selling purposes.

On the other hand, negative netflow values imply that outflows are currently overwhelming the inflows. Sustained such values can be bullish for Ethereum as it may be a sign of accumulation.

Related Reading | Here Are Two Scenarios For Bitcoin A Month Prior To FED Announcing Possible Interest Rate Hike

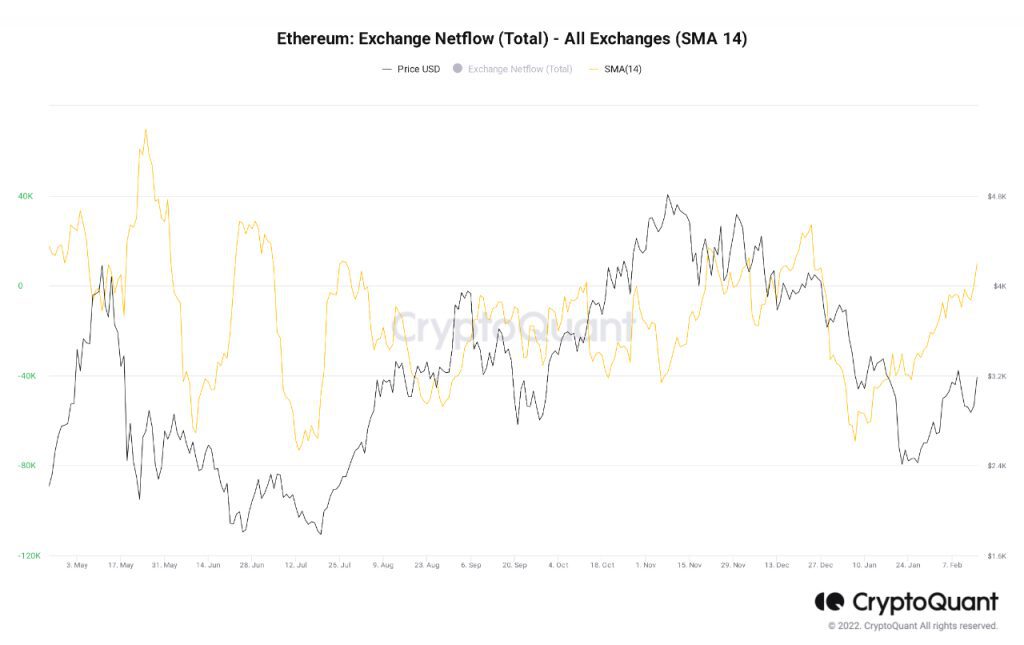

Now, here is a chart that shows the trend in the ETH netflows over the past year:

Looks like the indicator's value has recently risen above zero | Source: CryptoQuant

As you can see in the above graph, the Ethereum netflows have sharply increased to positive values in the past couple of weeks.

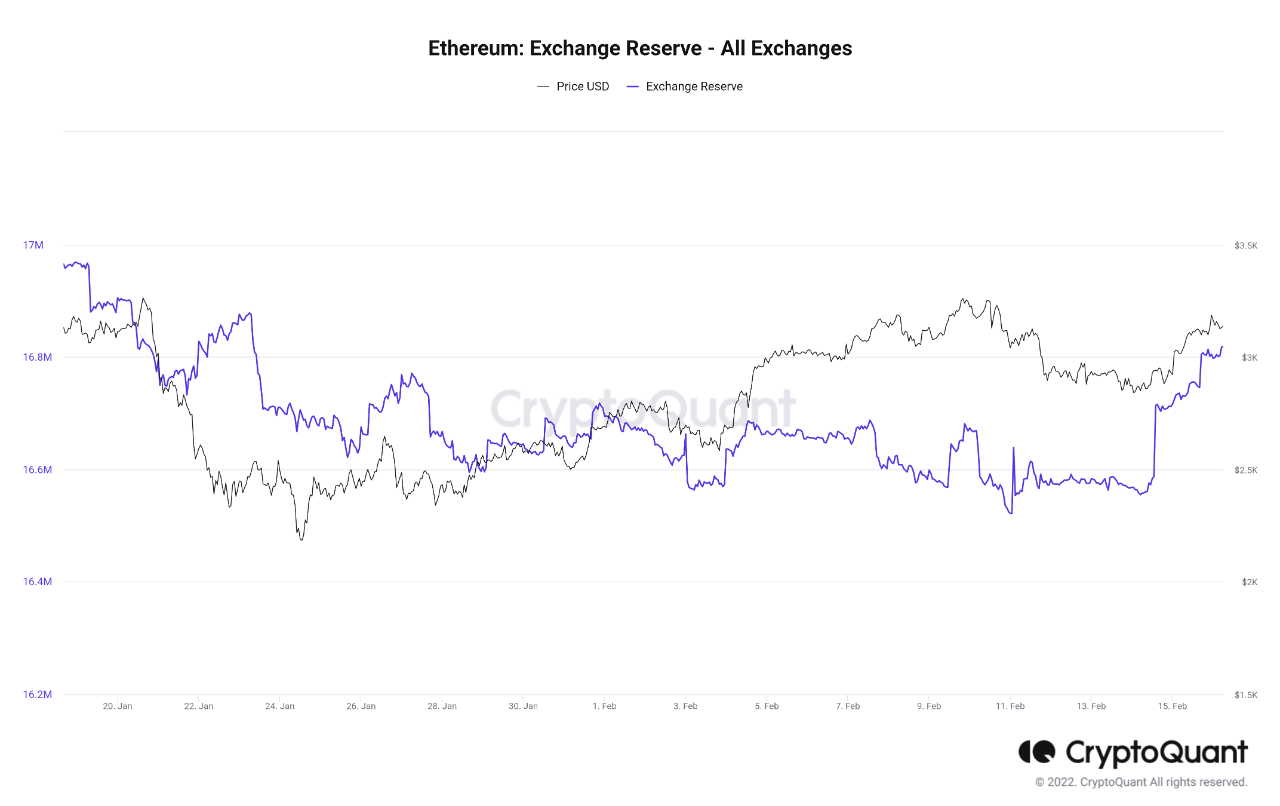

The effect of these net inflows can be seen through the exchange reserve indicator, which measures the total amount of ETH sitting on exchanges. Below is the chart for it.

The indicator seems to have surged up recently | Source: CryptoQuant

As the graph shows, the Ethereum exchange reserve has sharply increased in value in the past week. Which is expected, as the netflows have been positive lately.

Related Reading | Bitcoin Option Traders Seem Doubtful At Entering Directional Trades

The exchange reserve is often called the “sell supply” of the crypto. If the trend continues and the reserve keeps on going up, the near term outlook may be bearish for the price of the coin.

ETH Price

At the time of writing, Ethereum’s price floats around $3k, down 6% in the last seven days. Over the past month, the coin has parted with 8% in value.

The below chart shows the trend in the price of the crypto over the last five days.

The price of ETH seems to have dipped down over the past twenty-four hours | Source: ETHUSD on TradingView

Ethereum’s price had surged up to almost $3.2k a couple of days back, but has since come back down a bit to the current levels. At the moment, it’s unclear when the coin may show further recovery.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com