The investment preferences of venture capitalists can tell us a lot about diverse crypto assets in the ecosystem – beyond just their price performance. On that note, Messari’s Q3 roundup reveals a lot about one crypto in particular.

Shooting for the sun

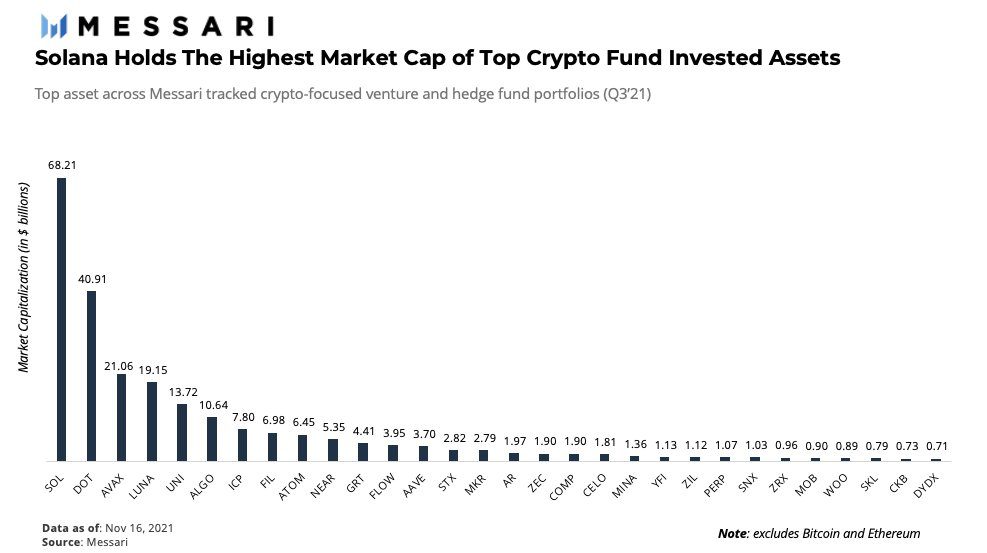

Messari Research showed that when considering the top crypto assets [besides Bitcoin and Ethereum] in institutional portfolios, Solana was the winner with a market cap of $68.21 billion.

Source: Messari Research

Solana’s stats put it far ahead of Polkadot [DOT] at $40.91 billion, Avalanche [AVAX] at $21.06 billion, and Terra [LUNA] at $19.15 billion.

However, Messari Research previously showed that the most commonly held crypto fund was Polkadot [DOT].

2/ Of the top invested assets, @solana possesses the highest-circulating market cap (with BTC and ETH omitted).@BreederDodo possesses the lowest circulating market cap of the top 15 fund-owned assets while @ArweaveTeam possesses the lowest circulating market cap of the top 5. pic.twitter.com/baamasmZ7f

— Messari (@MessariCrypto) November 17, 2021

Stats of Solana

Well, here is an important question- what could be some factors boosting Solana’s popularity with more institutional investors? Notably, to answer that, one element to consider is growth. In November, Solana’s daily active wallet count shot past 200,000.

Daily active wallets on @Solana crossed 200,000+ recently. Up 3x (~67k per day) since mid-September. Just getting started! 📈https://t.co/cuAiqnDvLf pic.twitter.com/pkLYaU6Iag

— Matty Tayl◎r (@mattytay) November 18, 2021

What’s more, Solana’s founders shared some more formidable stats during the Breakpoint Lisbon event in Portugal. These included a reported $15 billion in total value locked [TVL], close to 38 billion transactions, and more than 1.2 million active accounts.

Adding to that, the founders’ goals for Solana were one million developers and one billion users.

Coming back to Messari’s research, one sees that larger investors are mostly bullish on smart contracts. With Ethereum receiving more and more flak over its high gas fees, investors looking for a substitute platform are likely to consider Solana.

Source: Messari Research

Paypal getting into the game?

Venture capitalists aren’t the only ones looking at these altcoins. During an episode of the Unchained podcast, Paypal’s senior VP, Jose Fernandez da Ponte, spoke about the company’s crypto capabilities. The exec also commented that Paypal was tracking cryptos like Ethereum [ETH], Solana [SOL], Polkadot [DOT], and Algorand [ALGO].

Note that these were popular alts, according to Messari’s study.

However, it’s too early to decide if these cryptos are the ultimate winners. After all, competition is stiff and as Fernandez da Ponte himself commented,

“I’m sure that if you ask me six weeks from now I could give you four or five different names. This is how exciting it is…”