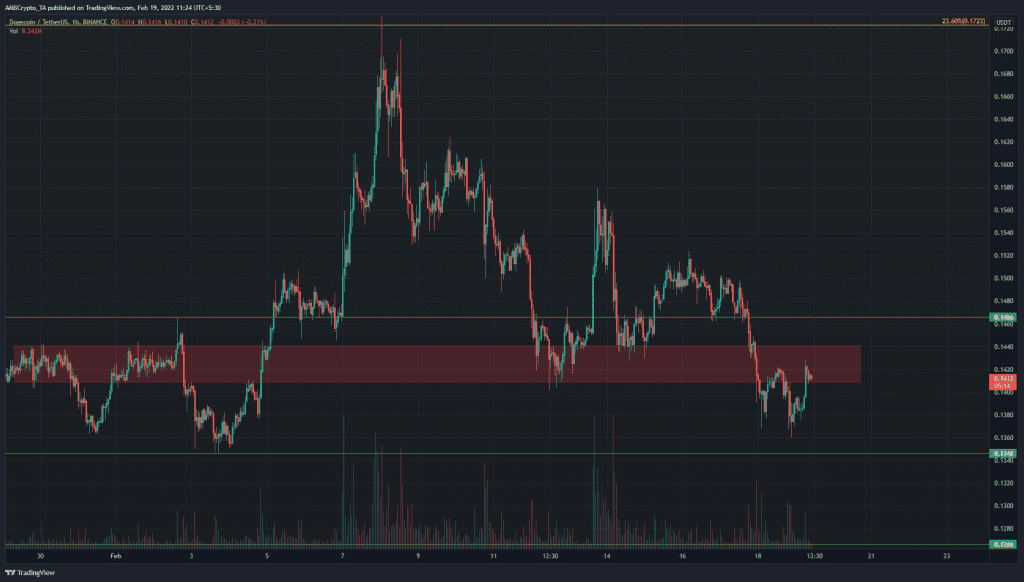

Dogecoin has seen quite a bit of volatility in the past two weeks when the price soared from $0.135 to $0.172 within a matter of five days. In the following week, most of these gains were retraced, and Dogecoin was once again pushed beneath a former area of demand. This showed that bears had the upper hand at press time.

DOGE- 1H

The $0.142 area (red box) was a place on the charts where liquidity appeared to be clustered around. In late January, the price stagnated here for a few days before DOGE could break out to the upside in early February.

A couple of days ago, Bitcoin dropped from $44,000 to $40,000. The price of DOGE too dropped straight beneath this red box area and retested it to confirm it as an area of supply. This meant that, at least at the time of writing, sell orders were more voluminous than buy orders in the $0.142 area.

Bulls would have to eat up these sell orders and push the price above $0.1466 before DOGE can be expected to make its next leg northward, which could reach as high as $0.158.

However, the general sentiment in the market remained bearish. Dogecoin’s short-term market structure was also bearish, and any move higher might be due to the low liquidity generally seen on weekends.

Rationale

The hourly RSI climbed above neutral 50 to show that bullish momentum could be on the rise. The MACD formed a bullish crossover. But was still moving beneath the zero line. In the context of the supply area at $0.142, a buying opportunity was not present.

The Directional Movement Index continued to show a bear trend in progress as the ADX (yellow) and the -DI (red) was above the 20 value.

Conclusion

Sentiment in the wider market was fearful as global stock indices have taken a hit recently. And, not to forget, crypto is a risk-on asset. The indicators implied that bullish momentum was on the rise but not yet dominant while the trend remained bearish. Weekends have lower liquidity than usual, in general, and a move to $0.146-$0.15 could be a selling opportunity.

Disclaimer: The findings of this analysis are the sole opinions of the writer and should not be considered investment advice