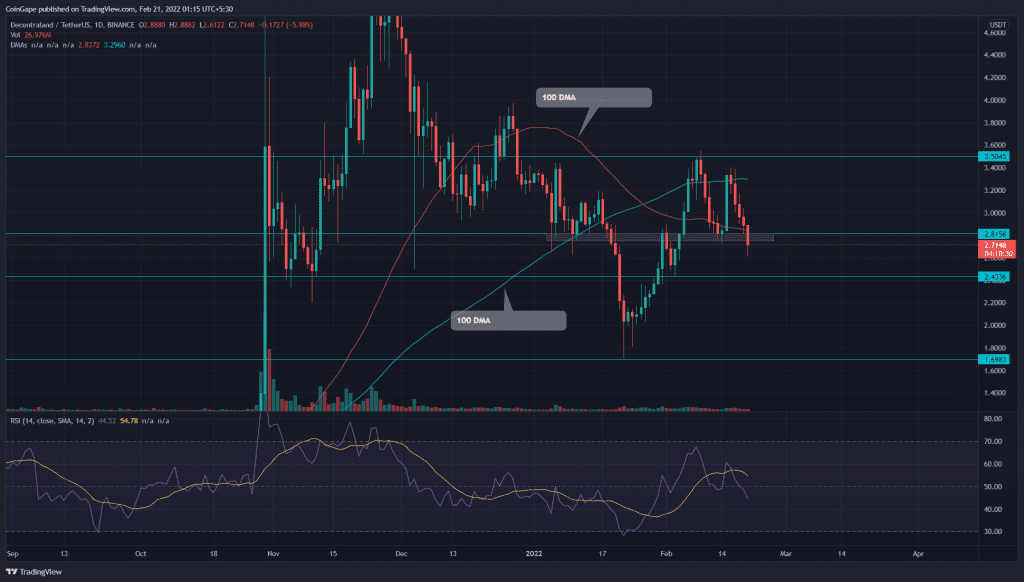

The current correction phase has tumbled the Decentraland (MANA) price by 24.2% from the February 9th high($3.45). Moreover, the fallout from the double top pattern bolsters the sellers to dump the coin even lower. Will sellers continue their dominance or buyers will have a comeback opportunity?

Key technical points:

- The 200-day DMA maintains the bullish trend in MANA

- MANA price formed five consecutive red candles, indicating an 18% fall

- The 24-hour trading volume in the Decentraland is $615 Million, indicating an 12% rise.

Source-Tradingview

On February 15th, the MANA price bounced back from the $2.81 support by completing morning star cable. The bullish candle indicated a 17.5% intraday and reached the $3.4 mark. However, the sellers immediately rejected the price and plunged it to $2.8.

The coin chart showed a double top pattern in the daily time frame chart, with the neckline as $2.8. Amid the ongoing sell-off in the crypto market, the MANA sellers pulled the price below this, representing a 6.16% intraday candle.

The Relative Strength Index(44) has just slipped into the negative zone, indicating the growing strength of sellers.

Along with the $2.8 fallout, the price also breached the 50 DMA line, offering an additional edge to traders. However, with the coin price trading above the 200-DMA, the overall trend remains bullish.

The MANA Price Could Bring Retest opportunity

Source- Tradingview

If MANA bears sustain below the $2.9 mark, the selling pressure would intensify and plunge the altcoin to the immediate support of $2.43, followed by $1.69.

Contrary to the above assumption, if buyers bounce off from the $2.43 mark, the bulls will drive to the $3.4,followed by $3.62.

- Resistance level: $3.41, $1.699

- Support level: $2.43., $1.69