Corrections are a part of any bullish market and the majority of Bitcoin investors are presently expecting BTC to recover from its current position. While the short-term action seems healthy at the moment, the daily chart had a mild bearish confirmation. This means there is a possibility of further drawdowns in the market.

Keeping the article with a specific point of understanding correction levels, it is important to note the recoveries may take place anytime. The present data set isn’t indicative of future trends or directions.

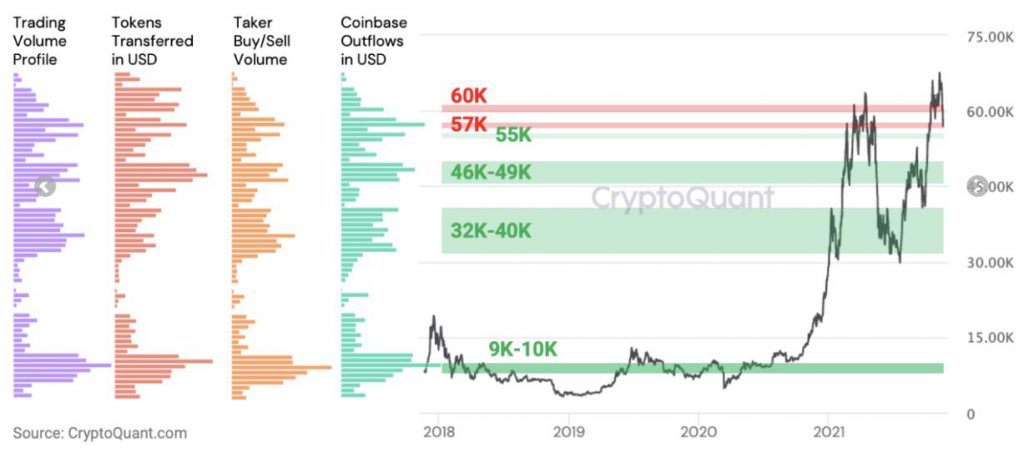

Understanding Bitcoin Market On-chain volumes

Source: CryptoQuant.com

Since the beginning of 2020, Bitcoin’s bullish rally has identified different zones of liquidity based on market and on-chain volumes. These levels essentially underline the strong range of trading sessions, where both buyers and sellers have heavily been involved to maintain order book flow.

Now, as illustrated in the chart, there are various factors, that are involved in understanding these support and resistance levels. These include trading volumes, token transferred value in USD, Coinbase outflows, and taker buy/sell volumes.

Now, without diving too much into details, Bitcoin’s recent bounce-back occurred at the first point of trading volume supports, which is between $57,000-$55,000(note: BTC jumped right from $55,600).

However, any further corrections indicate a slide down to the $46,000-$49,000 range, which is potentially another 10% drop from the current value. Previously, Michael Van Poppe, a crypto trader also suggested the same narrative.

Futures Market looks ‘Short’

One section of the market that is expecting further corrections are leverage traders. According to data, market sentiment is turning short-term bearish and traders are majorly shorting BTC in the perpetual futures market. Additionally, the estimated leverage ratio reached a new all-time high but collateral in the futures market had reduced.

With Open-Interest remaining high, it means that there might be concentrated shorting taking place in the charts. This may push the market towards more valuation slippage.

What about CME futures?

Selling pressure from CME futures has remained minimal. Since the end of May 2021, CME futures have not undergone overheating and the collective pressure has been more in terms of spot volumes.

While corrections are still expected, the next few days may push BTC above $60,000 as well. However, maintaining a position above $62,500 would only invalidate bearish speculation, otherwise, bearish pressure may sneak in yet again.