Smooth Love Potion (SLP) has fallen considerably since its Feb 10 highs. However, it has bounced at an important Fib support level and is showing early signs of a potential bullish reversal.

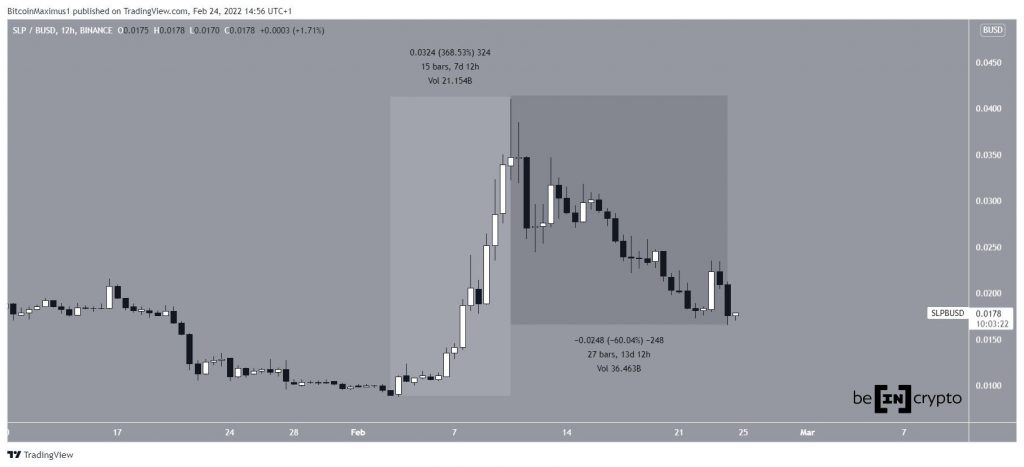

SLP has been moving upwards since Feb 3, when it reached a low of $0.087. The upward movement led to a high of $0.0409 on Feb 10. This amounted to an increase of 370% in slightly more than seven days.

However, the price has been falling since and has decreased by 60% over the past 13 days. This led to a low of $0.0165 on Feb 24.

Indicator readings for SLP

Daily time-frame indicators for SLP provide a very neutral reading.

While both the MACD and RSI are falling, the former is at 0 while the latter is at 50. Therefore, while the decrease is a sign of weakening momentum neither of the indicators have crossed into the bearish threshold.

However, the six-hour chart provides a more bullish outlook, since both the RSI and MACD have generated a very significant bullish divergence. This is a sign that a bounce could soon transpire.

If so, the closest resistance area would be at $0.025.

Wave count analysis

Cryptocurrency trader @TheTradingHubb tweeted a chart of SLP. stating that the token might have completed its correction.

The SLP wave count does suggest that the price has completed a five wave upward movement and an ensuing A-B-C corrective structure. The sub-wave count is given in red.

The bottom of wave C occurred at a confluence of Fib retracement levels:

- 0.786 Fib retracement support level (black)

- Length of wave A projected to C (white)

- Length of sub-wave one projected to sub-wave four (red)

These factors suggest the entire $0.015 – $0.0175 region is suitable for a bottom.

As for the longer-term count, it remains to be seen if the entire increase is part of a larger A-B-C structure (white) or the beginning of a new bullish impulse (black).

In any case, a movement towards $0.05, which would give waves A:C a 1:1 ratio seems to be likely.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.