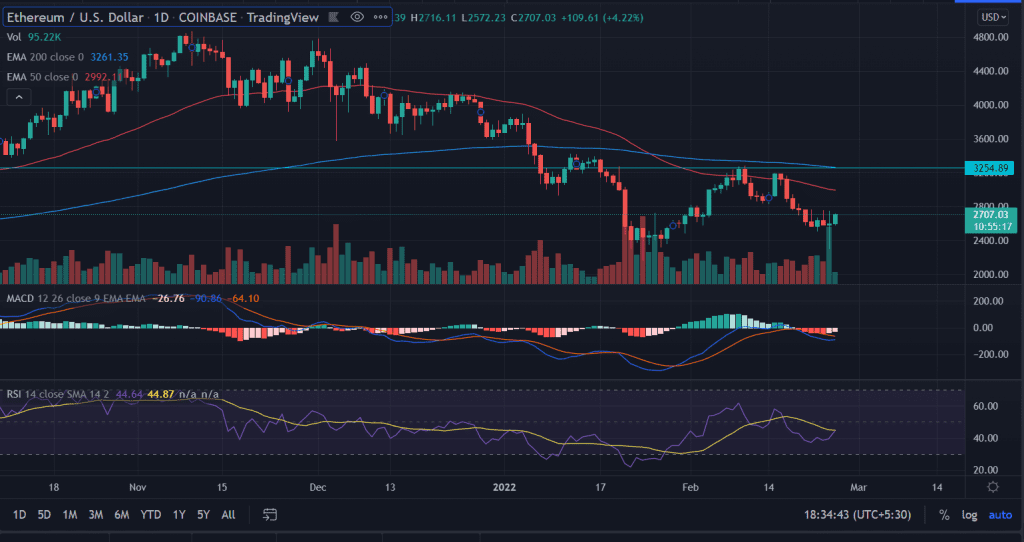

Ethereum (ETH) price makes a strong comeback on Friday bucking the previous session’s declines. After testing the weekly lows near $2,300 on Thursday. ETH opened higher with strong gains. However, Ethereum might face multiple hurdles even if buyers enter the market.

- Ethereum (ETH) price trades with remarkable gains on Friday.

- A decisive close above $2,800 will push ETH toward 25%.

- Momentum oscillators remain neutral indicating some reversal in the price.

As of press time, ETH/USD is trading at $2,675, up 3.08% for the day. The 24-hour live trading volume of the second-largest cryptocurrency by market cap held at $21,573,933,277 as per the CoinMarketCap.

Ethereum News

In the recent development, Ethereum gets an upgraded scaling testnet ahead of its scheduling time. zKSync announced an Ethereum Virtual Machine compatible Zero-Knowledge rollup years ahead of schedule. zkSync is a protocol responsible for implementing Ehtereum scaling platforms.

ETH price craves for 33% upside rally

Ethereum (ETH) has depreciated nearly 55% from the record highs of $4,867.81 made on November 10. After the recent update from the lows of $2,159 made on January 24th. But ETH price has remained pressured near the horizontal resistance line at $3,254.89. As investors met the crucial supply zone near this level and liquidated the holdings.

On the weekly chart, the formation of a ‘bullish’ hammer formation suggests price can seek further upside of 25% towards the $3,200 level.

On the flip side, if the price breaks the previous session’s low in the presence of increased selling pressure. A revisit to the January 2022 lows is plausibly followed by the lows of $2,651 last seen in July.

Technical indicators:

RSI: The Daily Relative Strength Index (RSI) reads at 44 with a probable bullish crossover.

MACD: The Moving Average Convergence Divergence (MACD) holds below the midline with a neutral bias.