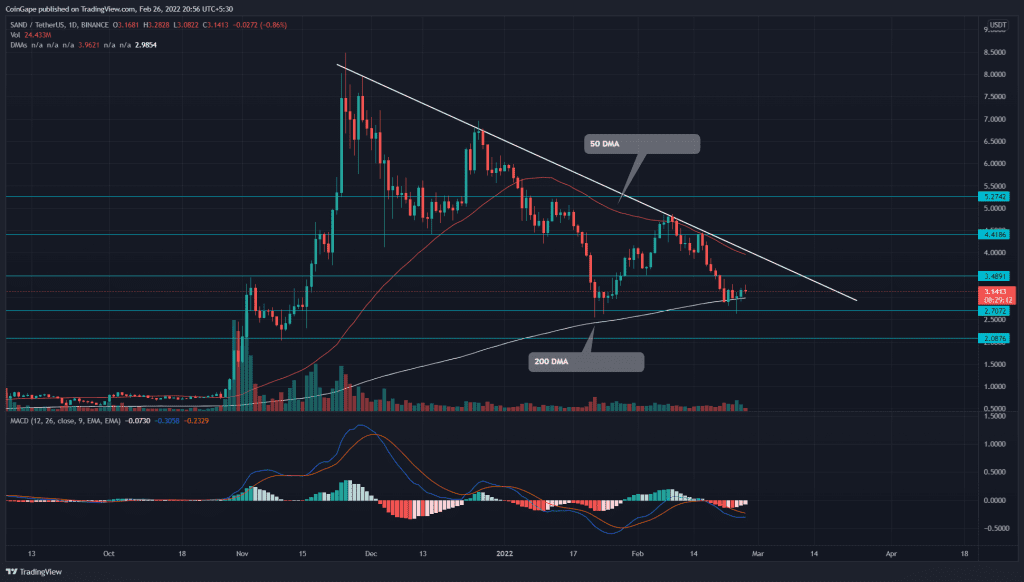

The recent correction plunged the Sandbox(SAND) price to the January low support($2.7). However, in confluence with the 200 DMA, the buyers bounced back from this support, indicating traders are interested in this dip. The following rally has soared 14.3% from the bottom support. Can bulls kickstart a genuine recovery?

Key technical points:

- The SAND chart suggests the $2.7 mark as an accumulation zone

- The MACD indicator could soon offer a bullish crossover among its lines

- The intraday trading volume in SAND price is $856.3 Million, indicating a 35.8% loss.

Source- Tradingview

On February 11th, the Sandbox(SAND) price showed a fake out of the $4.45 resistance. Under the influence of intense sell-off in the crypto market, the sellers pulled the altcoin to January low support($2.7), registering a 40% fall.

However, on Feb 24th, the coin chart showed a long-tail rejection at the 200 DMA($2.7), indicating the bulls are vigorously defending this support. SAND went green on the following day, trying to build bullish momentum.

The declining 20 and 50 DMA indicates aggressive selling from the traders. However, the coin price sustaining above the 200 DMA maintains a bullish trend.

The Moving average convergence divergence indicators show the narrowing gap between MACD and signal line is poised for a bullish crossover. The fading of red bars on the histogram chart indicates the weakening of the bearish momentum.

Sandbox Price Chart: 4-Hour Time Frame

Source-Tradingview

If SAND buyers rebound off the $2.7 support, it would suggest the traders are buying this dip. A possible reversal would drive the price 11.3% high, to the immediate resistance of $3.5. However, the buyers need to breach the descending trendline to get a better confirmation for recovery.

Alternatively, if the SAND sellers revert the altcoin from the overhead resistance, the coin price would retest $2.7, raising the possibility of a downtrend continuation.

- Resistance levels- $3.5, $4.41

- Support levels- $2.7 and $2