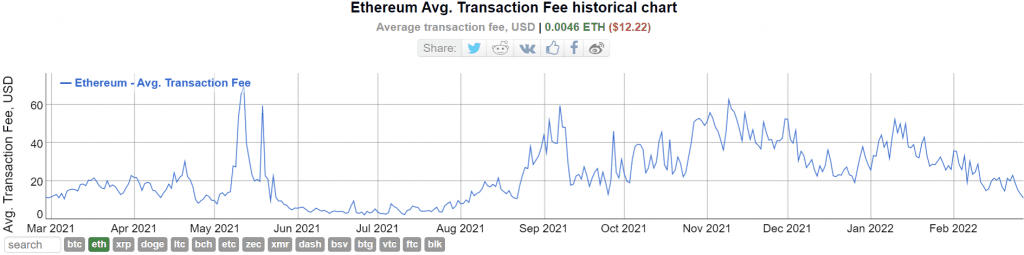

Throughout the previous year, Ethereum‘s rising gas fee was among the biggest concerns of the cryptocurrency industry. Well, especially due to Ethereum’s major role in DeFi and NFTs. The rising gas fees had inadvertently led to more congestion. Hence, higher transaction time and costs. Ethereum’s development team has been breaking necks over fixing these issues. However, the gas fee appears to be regressing of late.

Source: bitinfocharts

In fact, Ethereum’s average network fee hit a six-month low this week. And, has gone down by almost 80% from its recent high on 10 January. At the time of writing, an average Ethereum transaction cost 0.0046 ETH or $12.14, down from around $52 in early January.

Consecutively, Ethereum’s median gas fee has also slid by over 84% since early January. At the time of writing, it rested at 0.002 ETH or $5.3 per transfer, compared to the $29.92 noted on 10 January. Even though the gas fee was low earlier on 28 February, even so, it should be noted that the levels remain much higher than this time last year.

Also, a steep drop in gas used was recently noted on 15 February which has since recovered. But, it could provide an explanation for the fall in gas price, since both indicators are directly proportional to each other.

While a decline in gas used could itself be due to lower transaction costs, it could also be due to a fall in transactions themselves. The average transaction count on Ethereum has been on a decline since late November. Well, on 27 February, the Ethereum network undertook 1.12 million transactions.

One reason for this could be the continued decline in DeFi usage. The total value locked in DeFi smart contracts has gone down to $68.9 billion from $98.4 billion three months back. Much of this has been due to larger macro factors and the price decline most cryptocurrencies have experienced lately.

Souce: DeFi Pulse

However, another factor that could be pushing down Ethereum’s gas usage and the fee is the rise of alternate blockchains. While a token swap on Ethereum cost $8.75 at the time of writing, the L2 Zero-Knowledge (zk) Rollup zkSync charged $0.22 for the same services.

Source: l2fees.info

In fact, zkSync 2.0 was recently launched on Ethereum’s public testnet, which has been touted as the first EVM compatible zk rollup. It can also interact with smart contracts.