Waves (WAVES) has reclaimed an important horizontal level after creating a bullish pattern combined with bullish divergences.

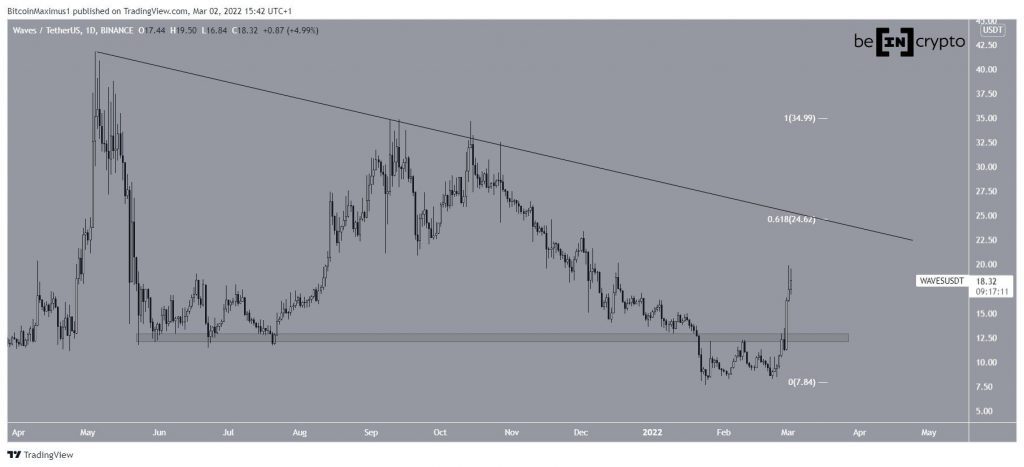

WAVES has been decreasing alongside a descending resistance line since reaching an all-time high price of $41.86 on May 4. The decrease led to a low of $7.56 on Jan 24.

The price has been moving upwards since, and increased significantly on Feb 28. The upward movement caused a reclaim of the $12.50 horizontal area, which had previously acted as support since May 2021. Since the area is now reclaimed, it renders the previous Jan 2022 breakdown as a deviation only.

The closest resistance area is at $24.50. It is the 0.618 Fib retracement resistance level and coincides with the aforementioned descending resistance line.

Future WAVES movement

Cryptocurrency trader @CryptoCapo_ tweeted a chart of WAVES, suggesting that the current upward movement is corrective.

However, the increase was preceded by a considerable bullish divergence in both the MACD and RSI during the Feb 4 and Feb 21 bottoms. The movement also created what resembles like a double bottom, which is considered a bullish pattern.

In addition to this, the RSI is now above 50 and the MACD is in positive territory. Both of these are considered signs of a bullish trend.

The previous time both these indicators gave the same reading was on Aug 2021. This preceded a WAVES upward movement of 112%, leading to a high of $34.90 in the process.

Short-term movement

When measuring the initial increase of Jan 24, the one that began on Feb 24 is 2.61 times the length of the original upward movement.

Therefore, it is possible that a short-term rejection will occur at this level.

This is further supported by the bearish divergence that has been developing in the RSI. I

If a rejection occurs, the closest support would be between $12.5 and $14, an area created by the 0.5 – 0.618 Fib retracement resistance levels.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.