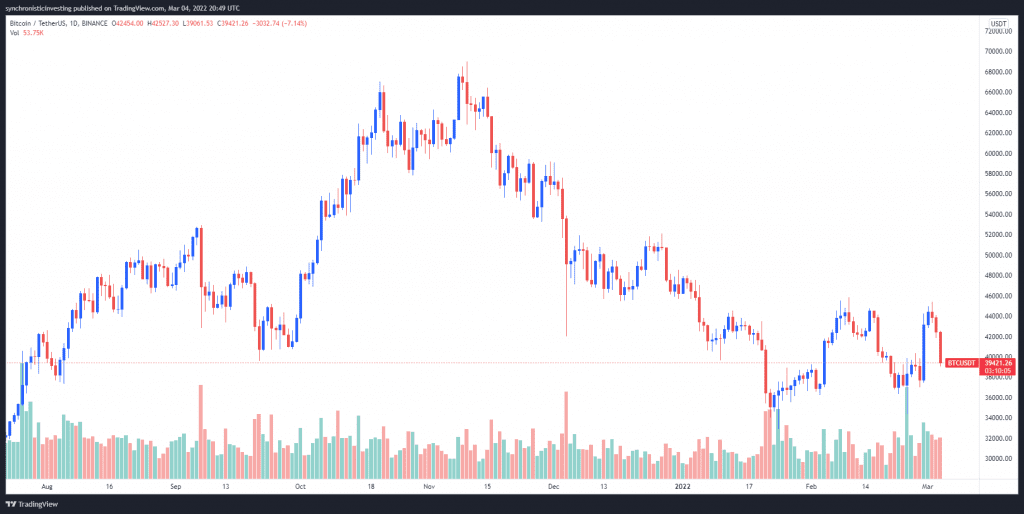

March 4 saw another day of seesaw price action for Bitcoin (BTC) and the wider cryptocurrency market as the global economic fallout from the ongoing conflict in Ukraine weighs heavily on a majority of the world’s financial markets.

Data from Cointelegraph Markets Pro and TradingView shows that after holding $41,000 in the early trading hours on March 4, a wave of selling in the afternoon dropped the price of BTC below $39,100.

Here’s a look at what several analysts have to say about the outlook for BTC moving forward as the world faces a period of increased economic uncertainty.

A potential retest of $38,000

According to Rekt Capital, $43,100 is an important level for BTC because the last time Bitcoin closed below this level on the weekly chat, its “price rejected to the red $38,000 area for a retest.”

Rekt Capital said,

“Upon a weekly close below the black at $43,100, BTC may possibly be positioning itself for a similar price trajectory.”

Traders say keep a close eye on the 50-MA

Further insight into which technical indicators traders have their eye on was provided by independent market analyst Scott Melker. Melker posted the following chart and highlighted the importance of the 50-day moving average (50 MA).

Melker said,

“Humans and bots alike are watching the 50 MA on the daily to see if it will hold. Got some bids there. That’s the blue line below price, for those who don’t know.”

Related: Bitcoin declines with US stocks as nuclear threat ripples through markets

Overhead resistance at $43,100

Michaël van de Poppe, another independent market analyst, presented a set of important resistance zones to keep an eye on should the price of BTC stage a weekend recovery recovery. Van de Poppe posted the following chart and noted that “Bitcoin is correcting as tensions around Ukraine are increasing, and fear is increasing too as gold is rushing upwards.”

van dePoppe said,

“Might be seeing a bounce, if we do, I’m looking at $43,100-$43,500 as a potential resistance point. Overall shaky markets, altcoins dropping too.”

The overall cryptocurrency market cap now stands at $1.76 trillion and Bitcoin’s dominance rate is 42.7%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.