Over the past two months, MATIC traders were actively selling on rallies using the descending trendline. The correction rally tumbled the altcoin by 50%, bringing it to the $0.1744 bottom support of $0.120. However, the RSI chart shows a positive divergence in the daily, suggesting a bullish breakout from the pattern.

Key points from the article:

- The MATIC sellers flipped the 200-day EMA into a valid resistance level

- The price action squeezing up at the patterns’ apex

- The intraday trading volume in MATIC is $662.3 Million, indicating a 29.5% loss.

Source- Tradingview

Source- Tradingview

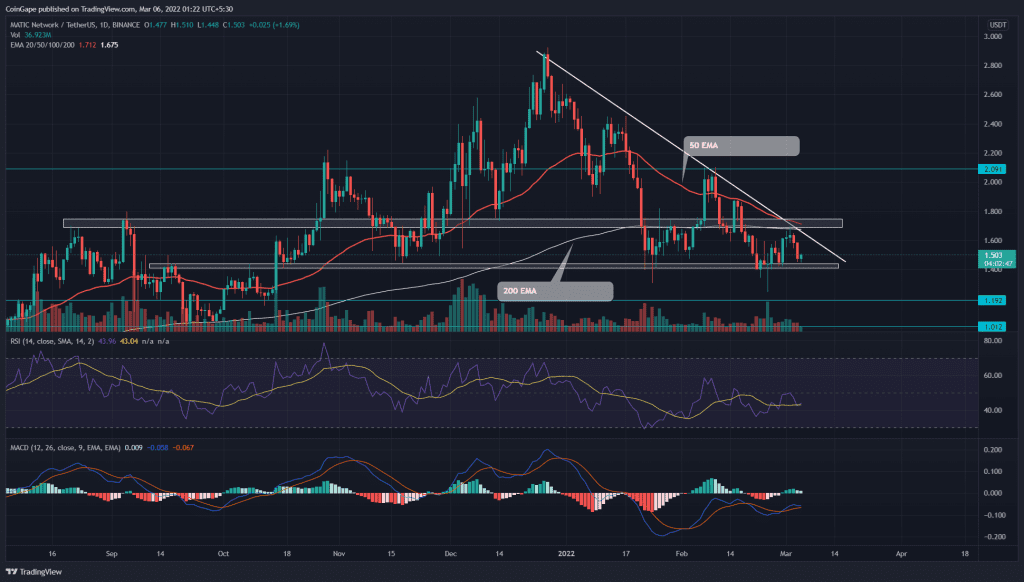

The MATIC/USD technical chart displays a descending triangle pattern in the daily time frame chart. Under the influence of this bearish pattern, the pair has lost 50% of its value from the December high at $2.9.

The recent rejection from the shared resistance of the descending trendline and 200-day EMA has plunged the altcoin by 13% and dropped to $1.4 neckline. However, the price action nearing the pattern’s apex could soon give a breakout.

Even though the descending triangle pattern usually bolsters the continuation of the ongoing downtrend. The daily RSI chart shows an evident bullish divergence on the last two swing lows, indicating the coin has a better possibility for an upside breakout.

A bullish reversal from the $1.4 support would allow buyers to challenge the confluence of major technical levels, i.e., the 200-day EMA, descending trendline, and $1.7 mark. A breakout and closing above these resistance levels would provide the first sign of price recovery, leading to the immediate target at $2.

On a contrary note, if bears manage to pull the altcoin below the $1.4 bottom support, the increased selling momentum would sink the MATIC price to $1 psychological support.

Technical Indicators

The MATIC price trading below the crucial EMA(20, 50, 100, and 200) states a bearish trend. Moreover, the coin chart shows the 50-and-200-day EMA approaching a bearish crossover, attracting even more sellers in the market.

However, the MACD indicator shows the fast and slow line approaching the neutral zone(0.00) from below, indicating the increasing bullish momentum.

- Resistance levels- $1.75 and $2

- Support levels- $1.4 and $1.2