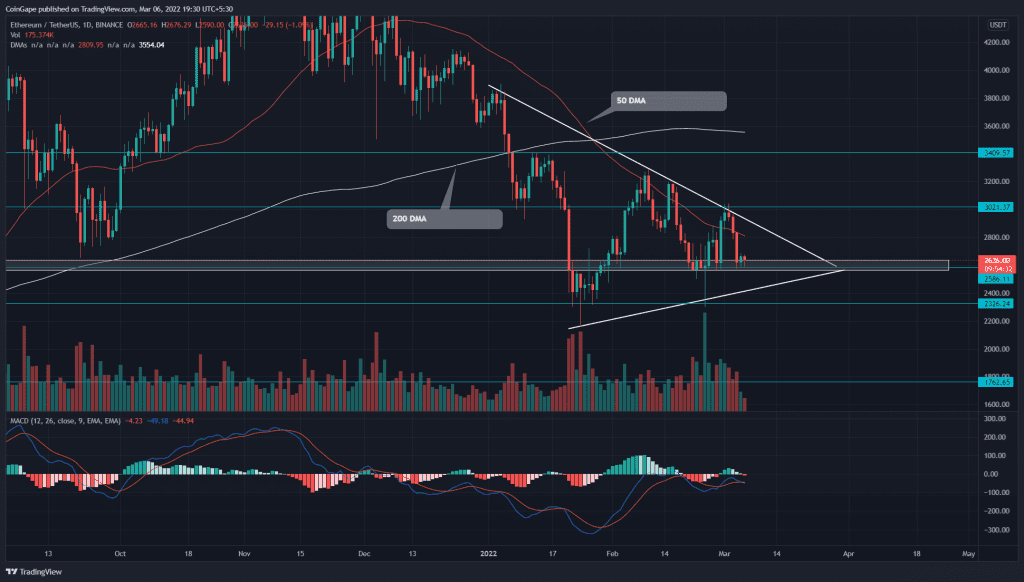

Over the past two months, the ETH/USD technical chart shows a short-term range bound rally. The recent reversal from the descending trendline has tumbled the altcoin by 13.5%, bringing it to local support of $2600. Can buyers revert the ongoing sell-off, or we will revisit the January low support at $2300?

Key points:

- The MACD indicators display a bearish crossover among the fast and slow line

- The ETH chart shows lower price rejection at $2600

- The intraday trading volume in Ether is $8 Billion, indicating a 35.37% loss.

Source- Tradingview

The Ether price action squeezing up between the two converging trendlines indicates the formation of a symmetrical triangle pattern. On 1st March, the altcoin crashed to the weekly support at $2600 after failing to overcome the descending resistance.

The second-largest cryptocurrency exchange hands at $2619, indicating a 13.5% loss in the last four days. The sellers are attempting to pull the altcoin below the $2600 support. If they succeed, the price will retest the bottom support trendline($2245).

However, if the bulls rebound again on the rising trendline, the ETH price would stay in range-bound action for a few days.

The crypto traders should wait till the price breach either of these trendlines. Because once they do, the ETH price could provide a strong directional move on the breakout side.

Technical Indicator

A bearish sequence among the declining DMAs(20, 50, 100, and 200) shows aggressive selling from the traders. Moreover, the recent reversal has nosedive below the 20 and 50 DMA, providing an extra edge for sellers.

The MACD indicator lines show a bearish crossover below the neutral zone, projecting a sell signal.

- Resistance levels- $3000, $3400

- Support levels are- $2600 and $2300