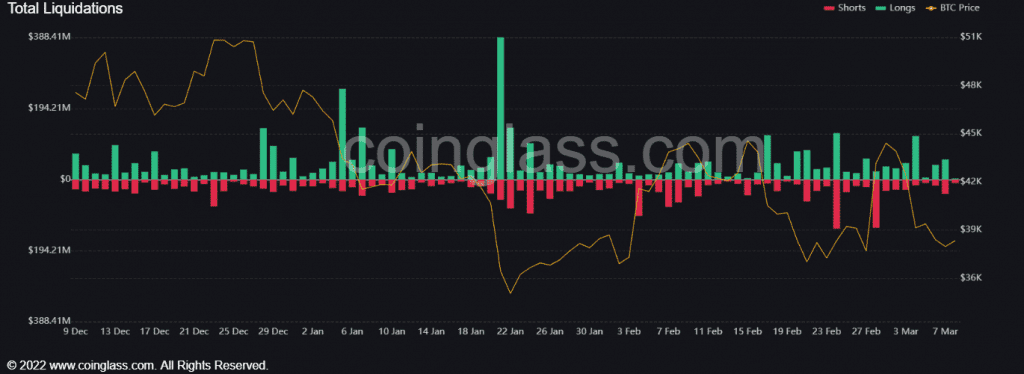

Crypto traders were caught off-guard as the market paused recent losses, liquidating $230 million in positions over the past 24 hours. Total market capital appeared to be holding around $1.7 trillion this week, after losing more than $200 billion in five days.

Shorts disappointed as losses pause

Traders positioning for a further decline in markets were disappointed as crypto traded steady, data from coinglass showed. $96 million in short positions were liquidated in the past 24 hours, with Bitfinex seeing the largest ratio of short positions at nearly 86%.

Sentiment had turned largely negative this week after the United States flagged possible sanctions on Russian oil, sending equity markets into a downward spiral. Crypto markets however, had remained resilient.

Bitcoin appeared to have found support at $38,000 after losing 17% in less than a week, with the token sticking to that level since Sunday. But this blindsided investors who had expected the currency to fall to as much as $34,000- the bottom of its losing spree in February.

Long positions burnt by no recovery

$121 million long positions were liquidated in the past 24 hours. The data showed that a majority of traders were positioning for an eventual recovery in the market, similar to the one seen towards the end of February, where increased whale trading caused crypto markets to surge by $400 billion.

Okex had the highest value in long positions among crypto exchanges, at $78 million. The largest single liquidation order also occurred on Okex, with a $3 million BTC-USDT swap.

Despite worsening market sentiment, institutional investment in crypto appeared to be resilient. Recent data from Coinshares showed institutional investors had bought $127 million worth of crypto products in the last week, even as sanctions against Russia pointed to more economic disruption.

The trajectory of Bitcoin over the last 10 years from being the preserve of a small band of technologists to an asset traded by institutional investors, demonstrates there is now significant liquidity and market interest to continue to support the long-term price appreciation of the currency.

-traders at Bitfinex

Focus now turns to upcoming regulatory decisions on crypto in the United States and Europe, as well as a Federal Reserve meeting next week.