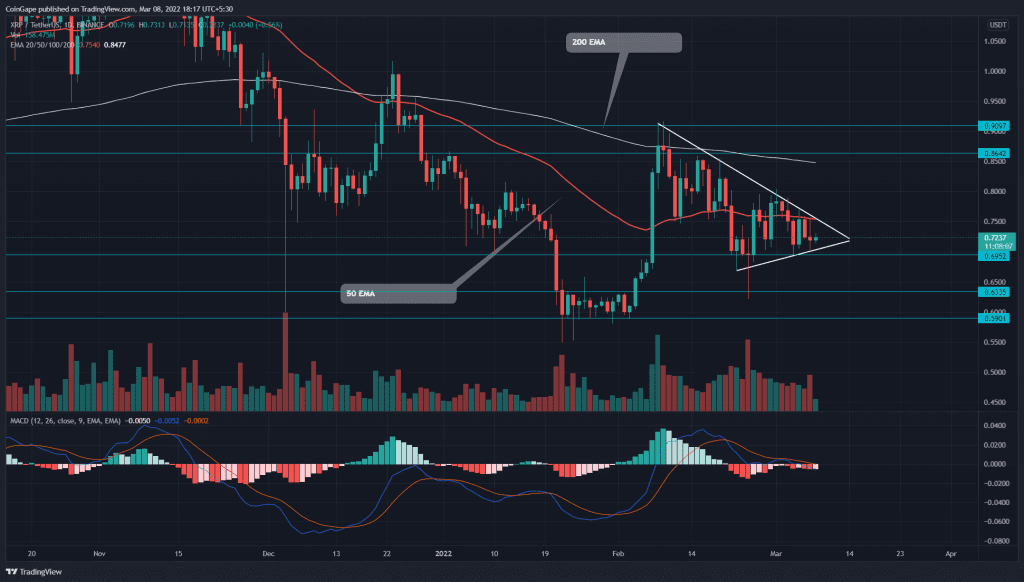

On Monday, the Ripple (XRP) price action displayed highly volatile, resting both the resistance and support trendline before settling with a Doji candle. However, the altcoin approaching the pattern’s apex would soon provide a directional rally to traders.

Key points:

- The XRP buyers face strong resistance from the 50-day EMA

- The intraday trading volume in the XRP is $2.4 Billion, indicating a 2.48% loss.

Source-Tradingview

The Ripple(XRP) price has been declining steadily under the influence of a descending trendline. So far, the altcoin has lost 20% from its previous swing high of $0.911 and continues to face dynamic resistance from this trendline.

However, an upcoming support trendline has prevented the XRP price from any drastic fall, resulting in the formation of a symmetrical triangle pattern. This range-bound rally is nearing the apex of the triangle pattern, indicating the coin is poised to give a breakout.

A breakout from either side of this continuation pattern would end this sluggish decline and give a clear direction to the rally. Therefore if buyers pierced the overhead shared resistance of trendline and the 50-day EMA, the traders would drive the altcoin by 25%, hitting the $0.9 mark.

Contrary to the bullish thesis, a bearish breakout from the ascending trendline would accelerate the ongoing sell-off and open the gates for the $0.6 mark.

Currently, the XRP price trades at $0.8, indicating a 1.5% intraday gain. Anyhow the traders looking for new entry should avoid the tug of war within the converging trendline and wait for a genuine breakout to grab their entry opportunity.

Technical Indicator

The flattish crucial EMAs(20, 50, 100, and 200) accentuate the range-bound movement in price action. The coin price trading below these EMAs gives the sellers a significant advantage.

The MACD indicator lines wavering around the neutral zone indicate a neutral tendency.

- Resistance level: $0.85 and $1

- Support levels: $0.745 and $0.59