Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

From its ATH, the king alt has been on a steep downtrend over the last four months. The descent saw a clash between the buyers and sellers at the $3,100-mark Point of Control (POC, red).

Assuming the altcoin obliges to its historical tendencies, ETH aims to test the $2,862-level before entering into a possible low volatility phase on its Bollinger bands (BB). The near-term retracements could find support at the $2,500-mark before the alt continues to mark higher troughs.

At press time, ETH was trading at $2,736.6, up by 6.42% in the last 24 hours.

ETH Daily Chart

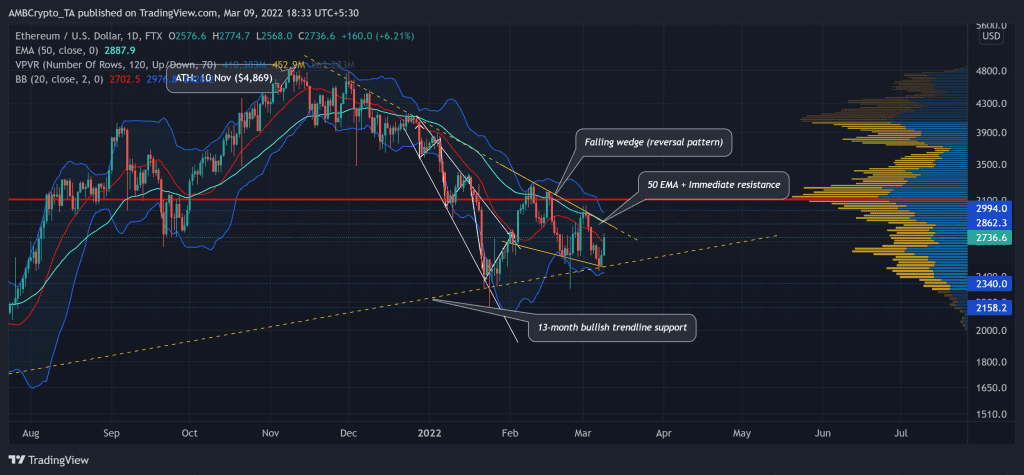

Since falling from its POC, the altcoin has seen multiple bearish engulfing candlesticks on amplified volumes that propelled ETH to poke its six-month low on 24 January. Also, the mean of the BB (red) stood as a sturdy resistance during the entire plummet.

Interestingly, ETH formed a descending broadening wedge (white) on a longer timeframe (one month). Historically, the alt saw a strong reversal from its 13-month bullish trendline support (yellow, dashed). This reversal rally then halted at the POC. Over the past month, ETH also formed a falling wedge (reversal pattern) on its daily chart.

Can the second-largest crypto repeat its history? If it does, then a potential retest of the $3,100 POC is conceivable in the days to come. But before that, it will face barriers at the $2,800-mark. This level is a confluence of its immediate resistance as well the 50 EMA (Cyan). Thus, a possible test of its trendline support before toppling its pattern should not surprise investors/traders.

Rationale

With the RSI marking higher lows, it bullishly diverged with the price and confirmed buying strength at its trendline support. Going forward, a close above the midline would heighten chances for a further recovery towards the 54-point resistance.

Also, the MACD lines were on the verge of a bullish crossover. If they cross over, they still need to cross the zero-line to claim an unrestrained bullish momentum.

Conclusion

Considering the harmony between multiple factors, a near-term pullback from $2,800 seemed to be probable. Following this, if the bulls gather enough force on increased volumes, a patterned breakout might be lurking around the corner. Besides that, investors/traders need to closely watch out for Bitcoin’s movement as ETH shares a 94% 30-day correlation with it.