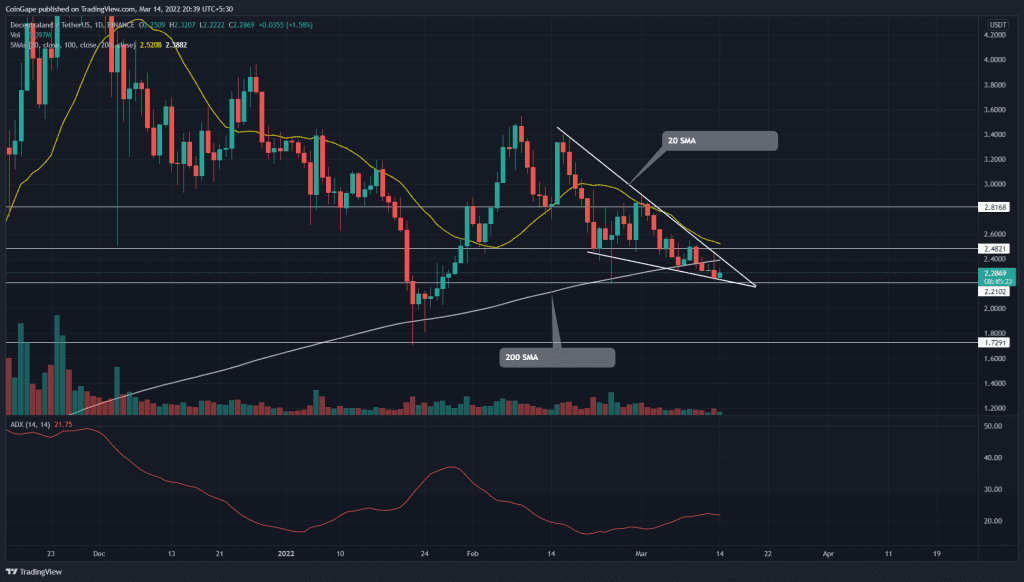

The Decentraland(MANA) traders are aggressively selling inside a daily-falling wedge pattern. Escaping this reversal pattern would end the sluggish down rally and give a directional move in price. However, the range between the merging trend lines should be considered a no-trading zone.

Key points:

- The MANA price is poised to break out from the wedge pattern.

- The MANA price slips below the 200-day SMA

- The 24-hour trading volume in the Decentraland token is $308.2 Million, indicating a 23.7% loss.

Source-Tradingview

On March 10th, the MANA/USDT pair turned down from the flipped resistance of $2.45 and plunged by 9.3%. The coin price gradually lowers within a falling wedge pattern. This reversal pattern could initiate a new recovery rally as the coin price breaches the overhead resistance. The price action nearing the apex of the price pattern can soon provide a decisive breakout.

A breakout and closing above the descending trendline would suggest the trader’s sentiment has switched from selling the rallies to buying the dip. The new renewed buying pressure could drive the altcoin to $3.4.

In contrast to the bullish thesis, if sellers pull the coin price below the support trendline, the altcoin would plummet to a $2 psychological level, followed by a January low of $1.7.

Anyhow, the traders need to wait for the price to breach either of the converging trendlines before they position their fund in MANA.

Technical indicator

The current correction rally has slumped the coin price below the 200-day SMA. Moreover, the high-wick rejection candle retesting the SMA indicates this support has flipped to resistance.

The average directional movement index(21) gradually rising suggests the increasing underlying bearish momentum.

- Resistance level: $2.48, and $3.81

- Support level: $2.21, and $2