Staking is attracting more investors with zero background in cryptocurrencies. Dmitrii Danilenko, CEO of aStake, gives his opinion on why this is happening.

Uncertainty has been caused by the pandemic. And, there is a high probability of a new economic crisis hitting the globe. So people are forced to think outside the box to diversify their financial risks.

Traditional finances no longer show such compelling returns. Moreover, in the face of a possible global crisis, depreciation of national currencies might happen, while cryptocurrency is gaining momentum. As a result, even the most conservative investors might start considering digital assets a great alternative to what the traditional financial system can offer. Staking can be a great entry point for these investors.

Here are a few reasons why new investors are willing to hop on board and invest.

Staking: Protection from FOMO

We are all promised compelling returns but entering into a new market requires a deep understanding of every move you make. Whenever the price goes up, inexperienced folks tend to buy, and when it drops a bit – panic-struck, they sell whatever they have. In staking, your assets are being locked for a specific period of time. So, basically, you are protected from buying high and selling low.

Guaranteed tangible returns fixed in crypto are still the returns

In trading (be it spot, margin, or whatever), you can lose all of your money, if you failed to make the right prediction, or the price just moved in the opposite direction. Staking looks far less risky.

Your guaranteed return will be paid out no matter what. For instance, if you stake 1,000 MetaHash Coins (MHC) and an estimated reward is 17%, in a year you’ll receive 1,170 MHC. And you’ll receive this sum in any case. Though the reward is paid in crypto, it’s something more tangible than trading crypto without knowing what cryptocurrency is and what your outcome for the trade will be.

Staking: A sense of belonging

High returns are not the only driving force behind staking. By taking part in staking, people feel they push forward blockchain development. Users group into communities around the product they believe in and invest their money in. Encouraged by the sense of belonging, these communities are propelling product growth.

The history of crypto is full of cases where the power of the community has made a drastic change in the project’s history. The case of GameStop VS hedge funds is interesting. A handful of retail investors from the WallStreetbets Reddit community decided to combat the hedge fund Malvin Capital. The fund was earning on GameStop’s falling share price.

Thanks to their endeavors, GameStop surged in value by 92% on Jan 26, leaped another 134% on Jan 27, and has traded more than 178 million shares. The WallStreetbets movement illustrated how the power of the crypto community works.

Another trend was sparked when meme token Dogecoin’s price increased by 3,500%. Soon after that, a new coin named Shiba Inu emerged and claimed to be Dogecoin’s primary rival. Over the course of several months, its price increased by 7,500% and turned a random investor into a billionaire.

Why is this all a big deal? What is import here is a sense of belonging. In particular, there’s a feeling you have made your personal investment in the future of the project. This is something that unites people and creates tangible value. In staking, where everyone is making this contribution, this sense is especially strong and obvious.

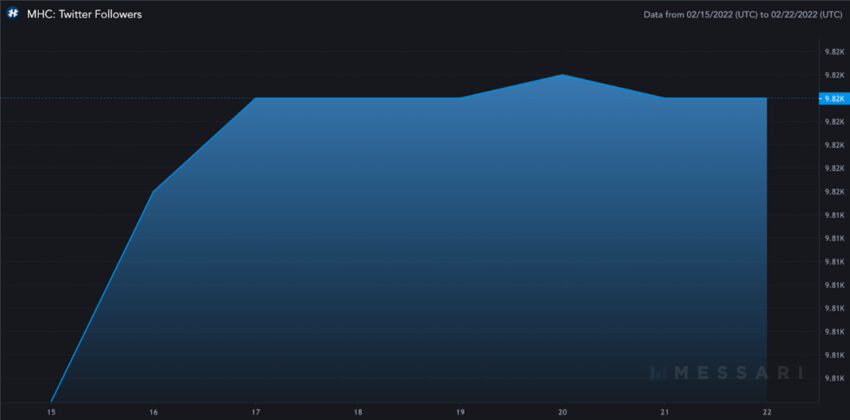

Source: messari.io

Having money that earns money

Especially now, when things are uncertain, people are looking for non-traditional options to diversify their financial risks. By investing as much as 10% every month, a user makes up a sort of capital over time that ensures a certain degree of stability in this unstable world.

For locking coins in the network, a user earns from 4% to 17% depending on the blockchain. Today, that 17% may serve as effective protection from inflation. Besides the staking reward, you may also earn on the growth of the cryptocurrency price. For instance, according to CryptoRank data, the MHC coin gained +169.6% in price during the last year.

Alternative Investments

People with an investor mindset are looking for new options to get passive income outside the traditional financial system. After the US dollar index slumped in 2020, investors started looking for different options in cryptocurrencies.

In a world where the government can print trillions of dollars at once, you start understanding that it’s impossible to solve the issue by using the same kind of thinking that created it. So staking can seem like a good new option versus traditional instruments.

At the beginning of February 2022, the total capitalization of the staking industry was $216B, as estimated by crypto analysts. This is because staking is an investment tool that you can use on your own.

Got something to say about staking or anything else? Write to us or join the discussion in our Telegram channel.

About the author

Dmitrii Danilenko is founder and CEO of aStake. Over the course of his career in the crypto industry, Dmitrii managed to raise over $380M of investment for different crypto projects in Asia, Africa, South America, and CIS.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.