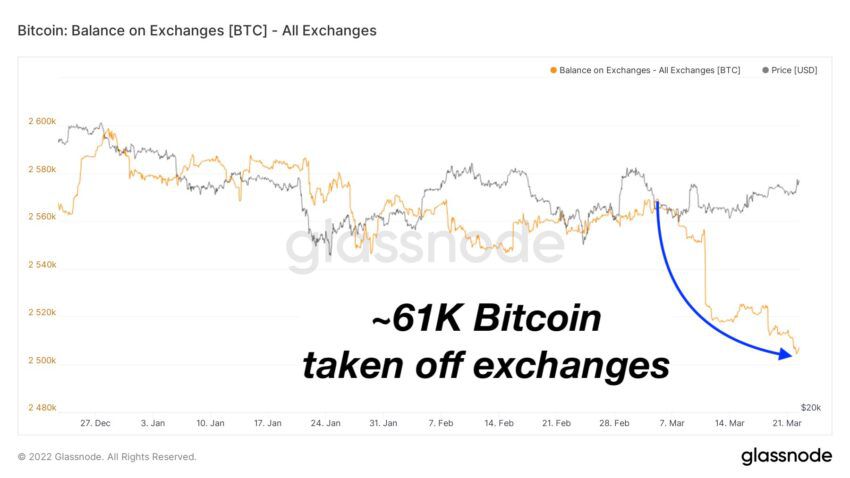

Data shows that large amounts of Bitcoin and Ethereum have been moved out of exchanges in the past 15 days, approximately 61,000 BTC and 151,000 ETH. The transfer of funds out of exchanges indicates that investors are holding.

The amount of bitcoin and ethereum leaving exchanges has grown significantly in the past few days, according to data from glassnode and IntoTheBlock. In the past two weeks, about 61,000 BTC and 151,000 ETH have been transferred out. That is worth about $2.6 billion of BTC and $492 million of ETH.

Bitcoin and Ethereum moved to holding

When major assets like BTC and ETH leave exchanges, it is generally a sign that investors are hoarding the assets because they expect a run upwards. The assets would be left on the exchanges for trading otherwise. As IntoTheBlock notes, when large amounts of ETH moved away from exchanges in Oct. 2021, it led to a 15% increase in price within ten days.

However, this is not a guarantee of a bull run. It’s simply that, in the past, there has been a strong correlation between price increases and assets moving off exchanges into other wallets.

Other signs also point towards growth. The number of Bitcoin and Ethereum addresses holding more than 0.1 of their respective assets has grown tremendously in recent times. This indicates that investors are slowly accumulating more of the assets, which is always a good sign for the market.

Positive developments provide more bullish signs for market

Bitcoin recently broke out above the $40,000, where it had been stagnating for weeks. Technical indicators suggest that a bullish run could be possible in the near future. Some analysts have set targets of $61,000 for bitcoin.

Ethereum has also had a positive uptick in price, especially since the news that the Merge had taken place on the Kiln testnet. Ethereum’s burn mechanism from EIP-1559 has also burnt over two million ETH since its implementation with the London Hard Fork.

Both assets and, by extension, the general crypto market is seemingly on the verge of a big movement. The past few months have not been easy on the crypto market, after a spectacular surge in late 2021. Investors are hopeful that the remainder of 2022 could be a good time for the market, especially with positive developments taking place outside the crypto space, like regulation.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.