After the first Bitcoin dip under the $60K level on 16 November, the chants of “buy the dip” surged with the expectation of a recovery. The king coin, however, had other plans. BTC’s price tumbled from a high of $66,281 to a low of $55,641 in just a week. This has thrown the market into a panic mode.

Panic taking over?

With the larger market mood looking bearish after another dip on November 23, sentiment played catch-up as spot price contrasted with the larger bullish signals from the metrics. As measured by the Crypto Fear & Greed Index, the sentiment had changed to correspond to spot market more closely, noting ‘Fear’ for the day.

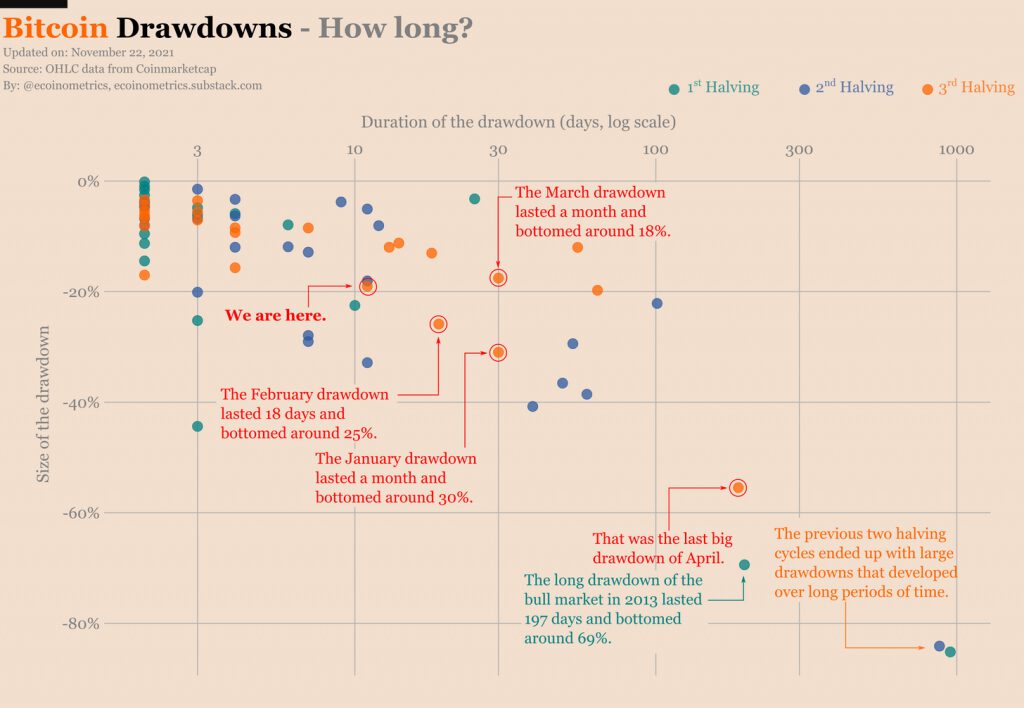

So, with the mood turning into panic, what was about this drawdown that fueled the market with such sentiments? Well, to be honest, nothing much. Notably, the current drawdown has lasted for 13 days (at the time of writing) as the current price was 19% down from the ATH price. Interestingly, this drawdown isn’t even a big one, when looked at in comparison to the previous ones.

In fact, there were several drawdowns during this cycle that fell in the same range as this one, as seen in the chart above. The March drawdown lasted a month and bottomed at around 18%, while the February drawdown lasted 18 days and bottomed around 25%. In hindsight this one shouldn’t bother the participants much, right? Well, as of now, not just the price action but metrics too presented a perplexing market situation.

Unique divergences

Data from Glassnode showed that long-term BTC HODLers were at a multi-year high. Markets may not yet be saturated with profit-taking sentiment as this cohort appeared to reduce their spending while continuing to add to their positions.

Looking at the Spent Volume Age Bands (SVAB), a sentiment and trend analysis can be made by identifying when the process of profit-taking or accumulation could begin. It is notable that consistent spending of coins aged greater than 1 month (> 5% of daily BTC on-chain volume) began in November 2020, and ended in April-May 2021.

After bottoming around $30K, Bitcoin saw one SVAB spike at $40K in August, and another above $60K in October, as seen in the chart below.

Source: Glassnode

Since then, SVAB values have reverted back to 2.5% of daily volume, which suggests that older coins are increasingly dormant, more so as the price pulls back. Arguably, this would mean that longer-term HODLers were reducing their spending, and are more likely to be adding to positions.

Further, the total supply held by STHs is at multi-year lows less than 3 million BTC, which in turn means that the LTH supply is at a multi-year high.

Source: Glassnode

The aforementioned data is typically seen at the end of bear markets and in early bull markets, usually following long periods of accumulation. However, this time it’s a unique case when the price is near ATH and LTH supply is at ATH levels too. This could present interesting turns in BTC prices going forward.

That being said, despite the downside volatility, BTC’s monthly retest is still intact as the coin was still retesting the monthly $58.7K level as support. So it looks like ahead of the monthly close BTC’s price could keep swinging and a new month could come with renewed highs (or not). Nonetheless, for now, the long-term prospects of the coin looked strong as the top coin tested the near $55K levels at press time.