With the larger market including Bitcoin and most large-cap alts looking rather calm Chainlink’s 7.93% daily gains raised a considerable amount of attention for the 19th ranked altcoin. Of the top 20 coins by market cap, Chainlink had the highest daily gains as LINK’s trajectory was in a five-day rally.

At press time Chainlink traded at $25.75 noting 7.73% daily and 24.18% weekly gains. After spending more than one month under the $25 price level, LINK’s recovery above the psychological price barrier seemed to have reignited a wave of optimism for LINK HODLers.

Price back on track?

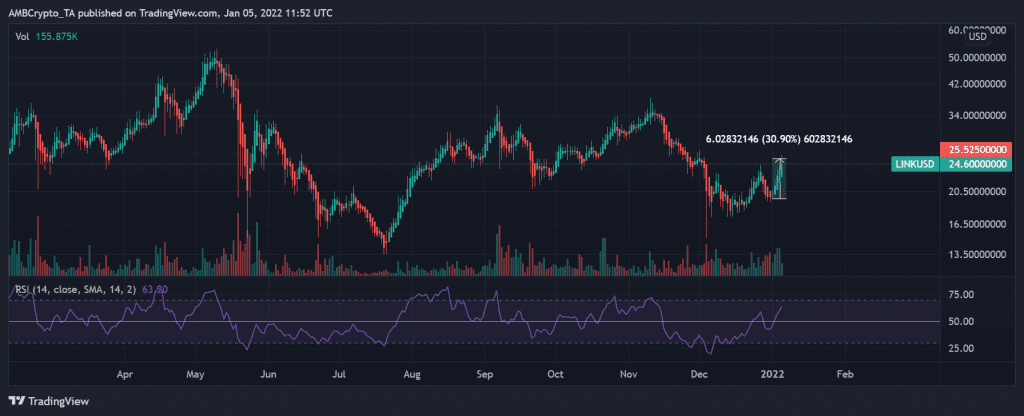

Chainlink’s price recovered from a drop below $20, posting over 30% gains over the last five days. Entering 2022 the coin’s trajectory has been largely bullish as its price appreciated to $26.08 on 5 January alongside rising in the Relative Strength Index.

The RSI breakout above the 50-mark after a continued downtrend has aided LINK’s price growth in the past too. That said, a move above the $27.48 level could further ease sell-side pressure as the 11% or 74.38k addresses that were At the Money (breaking even) would be in profit then. As per Global In/Out of the Money the next bigger resistance could be faced around the $30 mark which also plays a psychological barrier in the coin’s bullish trajectory.

For now, with the $25.8 resistance being tested if the bullish trajectory continued higher highs could be made.

What about the network?

With price picking up, trade volumes have seen an uptick too presenting higher retail interest as Chainlink’s five-day rally continued. At the time of writing BTC oscillated near the $46K mark looking mostly neutral while LINK’s price rise. Interestingly, LINK’s correlation with BTC had dropped as the price started the upward move.

A similar drop in correlation to BTC has often accompanied price gains in the past. That said, LINK’s volatility still remained at the lower levels which could act in favor of the larger bullish tone.

The vibrancy of the network had once again returned as 7-Day new address change was +11.22% while the 7-Day active address change was +17.98% at press time. However, the daily active address count hadn’t drastically changed as it did during LINK’s previous rallies.

Further, Open Interest change on perpetuals market was +13.05% while that on the Futures market was +9.26% as over $1.9million shorts were liquidated in the last 24-hours as per data from Coinalyze.

So, with retail interest and activity in the network glimmering what did LINK lack?

Shortcomings

Institutional push, which could be key to the rally still looked absent from the scene as large transaction volumes (in USD) were still pretty low. An uptick in the same alongside higher retail interest could push the coin towards higher resistances.

That said, the average HODLing time for LINK was 2.8 years which was considerably high, and that coupled with a rise in HODLers over time has made the altcoin ripe for a breakout.

For now, a sustained uptick in address activity alongside rising euphoria could aid LINK but the crucial higher resistances could still bring some friction in the days to come.