Developments around the open-source DeFi protocol, AAVE looks like a non-stop activity. In July, the community agreed to launch GHO, its own stablecoin. Now, AAVE has proposed something new.

This time, the community has requested its voting and governance community to approve retroactive funding for AAVE version 3 (V3).

So how much is AAVE looking at, and what exactly is the project trying to achieve?

Breaking it down

According to the request, the funding aims to strengthen the Aave ecosystem and develop essential features on the AAVE V3.

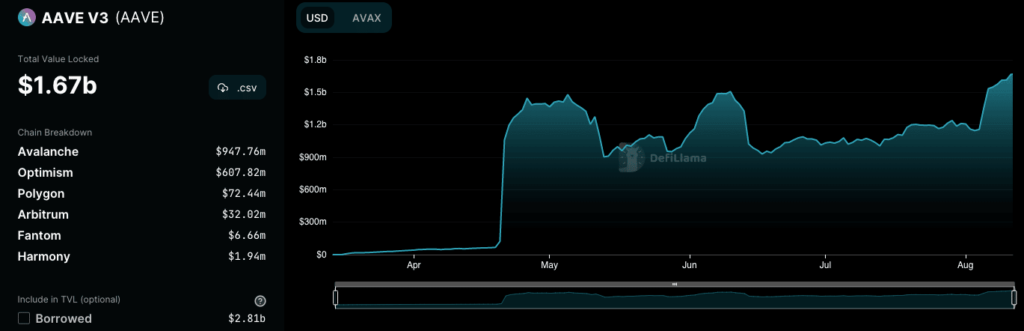

DeFi aggregator, DeFillama data showed that the V3 has been performing well of late.

Based on the information, AAVE V3 had contributed $1.67 billion to the overall Total Value Locked (TVL) of AAVE.

This supply has helped the Aave protocol hold onto its third position with TVL now worth $7.42 billion.

With seven chains on it, it may seem that AAVE’s recent activities may potentially displace Lido Finance [LDO] off the second position.

At press time, AAVE had registered a 5.20% increase in TVL over the last 24 hours. What else did AAVE mention with regards to the recent funding request?

Aave proposed that its Decentralized Autonomous Organization (DAO) approve separate sums of $15 million and $1.6 million for work incurred and audit, respectively, to facilitate the development.

The proposal noted the advancement and success of V3 would be an excellent development for other versions inclusive.

Layer-two (L2) network improvement, high efficiency, and isolation modes have been the major factors for the protocol. According to the proposal, integrating these features will allow seamless use of different networks on the protocol system. Aave said,

“V3 has also seen demand for stable Efficiency Mode (eMode), with proposals for new asset listings such as this one for FRAX continually taking advantage of Aave V3’s capital efficiency. In light of recent significant crypto market events, risk management features such as isolation mode have also proven to be prescient”

As for the DeFi ecosystem, Aave believes retroactive funding and V3 advancements would drive innovation. At press time, there had been some response from the Aave community, with many responding positively to the request with signs of live funding very likely.

In light of the request, AAVE had already gained 10.31% from its previous day’s price. Another thing that followed the update was a massive volume influx—a 137.98% uptick in the last 24 hours.