While technical analysis offers insight into the performance of crypto assets and where the market sentiment lies, ‘buying the dip’ at a specified ‘bottom’ is not always as easy as many people make it out to be.

In a newly published report titled “ Whale Watching During the Dip: Where’s the Accumulation Happening?”, analytics platform Santiment noted,

“Buy low, sell high sounds easy in practice. But in a wobbly, volatile market like cryptocurrency, defining what the “highs” and “lows” actually are is next to impossible, and always a relative science instead of precise.”

The big boys are still buying AAVE

According to the report, Santiment found that AAVE tokens ranked the highest amongst the top three crypto assets that the whales have accumulated since the general crypto market downturn started. Furthermore, considering the index for AAVE holding addresses since the beginning of the year, Santiment asserted,

“ We’ve just seen a huge accumulation spike from the 10k to 1m addresses, which make up 47.7% of the supply holders now. Prior to 20 June, they were holding 42.3% of the supply. As you can imagine, a sudden one-day accumulation of over 5% of the supply from these millionaire holders is a welcome sight for future price prospects.”

But wait!

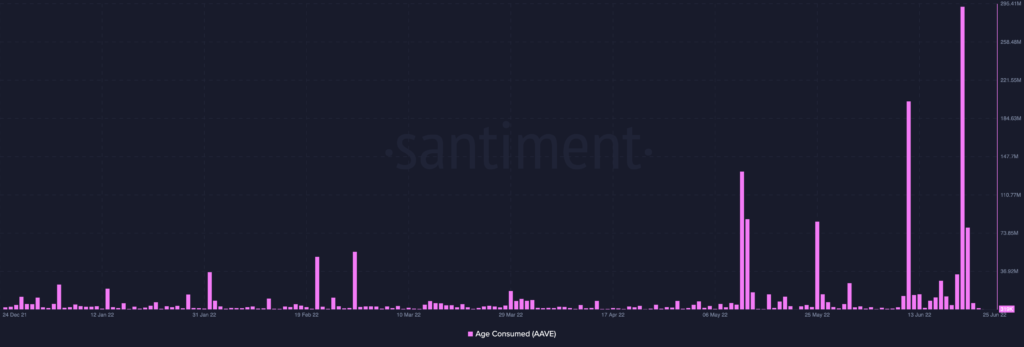

While it is noteworthy that whales hold over 45% of AAVE tokens in circulation, a look at the index for previously idle AAVE tokens that have now moved addresses revealed something interesting.

In the last few days, there has been a sudden spike in the number of previously idle AAVE tokens that have now changed addresses. This indicated that addresses that have held on to AAVE tokens at the start of the year were starting to let go as the price of the tokens has seen over 70% decline in the last 180 days.

In addition, as noted by Santiment in its report, it is true that “ in a speculative market like crypto, top holders are still dictating where prices are moving next.” However, increased whale holdings for AAVE tokens have had little impact on price.

A look at the exchange flow balance since the beginning of the year showed that more AAVE tokens had left exchanges than entered. At each point that this metric posted a negative value, the AAVE token declined in price.

Furthermore, at press time, the exchange flow balance stood at -18.8k. This meant that although the price was up by 8% in the last 24 hours, a retracement was imminent.

Furthermore, although the whales hold a significant supply of AAVE tokens, data from Santiment revealed that, on a 7-day average, the whale transaction count index has declined since April.

For transactions above $100k, the whale transaction count registered some highs at the beginning of the year. However, this plummeted by mid-march. A correction was spotted at the end of March but was only transient due to the bloodbath of April.

Since then, this has only registered low figures. At press time, this metric stood at 81. For transactions over $ 1 million, a similar progression was followed. At the time of writing, this stood at six.

According to the report, the other two crypto-assets that have been widely accumulated include SAND and LRC. Curiously, ADA, YFI, and DOGE were spotted as the leading assets that whales are running away from.