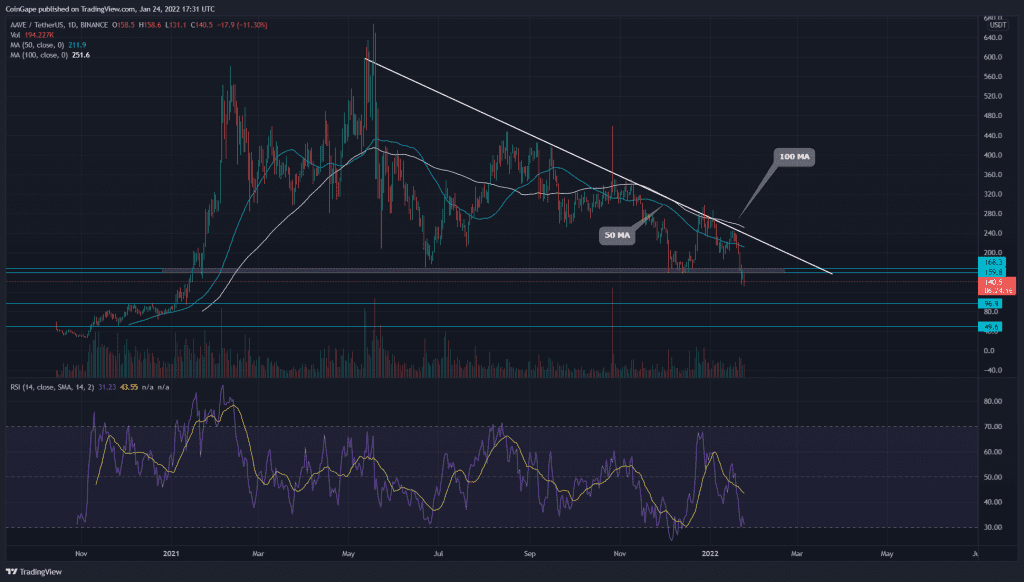

The Aave technical chart displays an overall sideways trend. However, the price action has been resonating in a descending triangle pattern, which eventually fallout from the $160 neckline. The coin price sustaining below this level could extend the correction rally and pump it beyond the $100 mark.

Key technical points:

- The daily-RSI Slope approaches the oversold region.

- The 20-and-100-day MA hints at a bearish crossover

- The intraday trading volume in AAVE/USD is $333.7 Million, indicating a 9.3% fall.

Source- Tradingview

In our previous coverage of Aave technical analysis, Coingape warned about the possible bearish reversal from the falling trendline, which plunged the coin price to $200 support. Moreover, the technical chart revealed a descending triangle pattern in the daily time frame chart.

The recent blood bath in the crypto market devalued the AAVE price by 38% in just a week. The coin price gave a bearish breakdown from the $160-$150 neckline, inviting more sellers in the market.

The AAVE/USD technical chart shows the 100 MA line provides dynamic to the coin price. Moreover, the bearish crossover of the 20 and 50 MA could accelerate the ongoing selling.

The daily-Relative Strength index slope crashed to the 30% mark, preparing to enter the oversold region.

AAVE Price Could Drop To The $100 Mark

Source-Tradingview

On January 22nd, the AAVE price-free fall breached the $160-150 support zone. The price action showed a 1-day retest, followed by today’s 7% red candle. If the sellers managed to sustain this coin below the $150 mark the coin price could pump to $79 or $50 mark.

The super trend indicator turned red in the 4-hour chart, confirming the bearish trend in the market.

- Resistance levels- $3000, $3670

- Support levels are$79 and $50