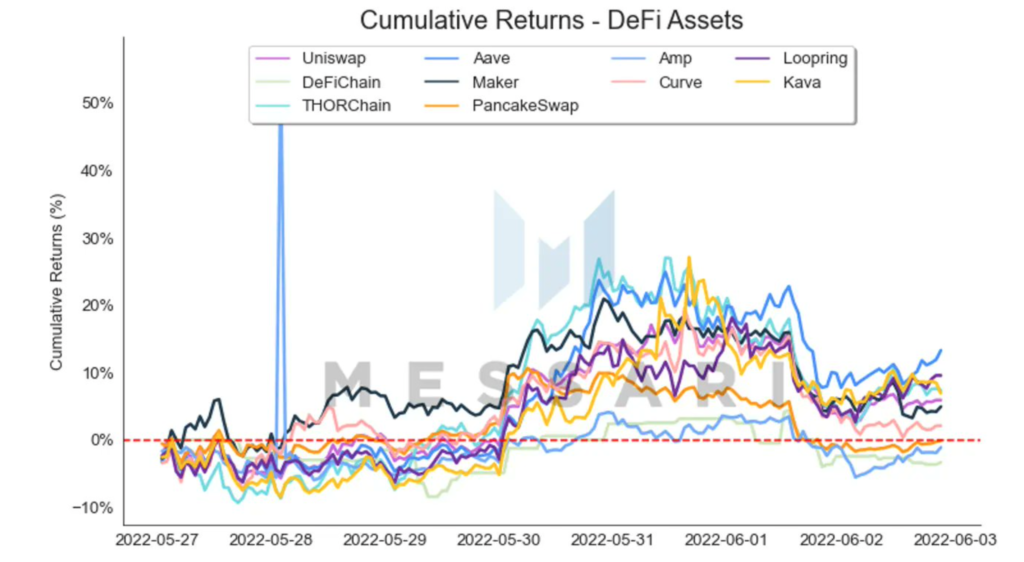

DeFi assets traded with fairly high unison, as a calmer environment coupled with a lack of catalyst events among the top assets graced the sector this week. However, one platform indeed stood out amongst the rest…

Built different, maybe?

One of the most emerging DeFi cryptocurrencies, AAVE is a decentralized lending system, that allows users to lend, borrow, and earn interest on crypto assets. The AAVE protocol incorporated the most powerful upgrade that led to the token skyrocketing by 97%, thus, strengthening DeFi capabilities. The V3 of the AAVE Platform introduced significant changes to the platform.

These changes included enabling cross-chain transactions, and provision of higher borrowing power. Even the listing of new assets while protecting the protocol, and gas optimization among several other upgrades to the system. AAVE’s performance after protocol launched its V3 seems to have taken a turn. Let’s see to which side…

In terms of cumulative returns within DeFi, AAVE lead the sector, finishing the week with a 13.3% gain. Here’s the graphical representation:

In fact, the AAVE token has emerged as the most traded cryptocurrency by the 1,000 biggest Ethereum ETH/USD wallets in the past 24 hours. It was also ranked fourth among the ten most purchased tokens.

The token also stood second among the most used smart contracts by the Ethereum whales during the 24-hour period, according to data from cryptocurrency data platform WhaleStats.

JUST IN: $AAVE @AaveAave now on top 10 by trading volume among 1000 biggest #ETH whales in the last 24hrs 🐳

Peep the top 100 whales here: https://t.co/jFn1zIOq03

(and hodl $BBW to see data for the top 1000!)#AAVE #whalestats #babywhale #BBW pic.twitter.com/xy3s1ro9M4

— WhaleStats – BabyWhale ($BBW) (@WhaleStats) June 3, 2022

To support this narrative, even the holders count, as of 3 June, saw a sudden uptick as per CoinMarketCap. At press time, the count stood at 111,554, which can be considered as a significant increase from 2 June.

What’s more in store…?

Well, AAVE did take a beating despite the highest cumulative return margin. At the time of writing, AAVE suffered a fresh 2% correction as it traded at the $105 mark. However, there’s another narrative here, and a grim one. AAVE’s on-chain metrics didn’t quite showcase anything to brag about.

The number of addresses created on the network saw a 55% decline in network growth. Although a high of 603 new addresses created on 29 March. Further, 446 on 13 May, the growth of the network has not witnessed any significant improvement.

Could this be one of the reasons why the token saw a bearish picture?