According to a tweet by Aave protocol, the plan to compensate Aave company members with $16.28M in retroactive financing for the development of Aave Protocol V3 has been green-lit.

Now, the question – Did the community and prospective buyers rejoice in this development?

New updates are here

The V3 protocol aims to solve many problems. It will focus on new modes which allow increased capital efficiency whilst limiting risks for the protocol. Furthermore, it would incorporate risk management improvements, while providing additional protection to the protocol and many other L2-specific upgrades will also be made.

The announcement of this update made an impact on the crypto-community with some crypto-whales taking notice. In fact, according to a tweet by WhaleStats, $AAVE is back among the top 10 purchased tokens by the 100 biggest BSC whales in the last 24 hours.

Interestingly, whales aren’t the only community that AAVE has garnered interest from, AAVE has been making some noise on social media too. The altcoin has seen a 12.5% increase in its social mentions over the last 7 days, which seems to be a good sign for AAVE.

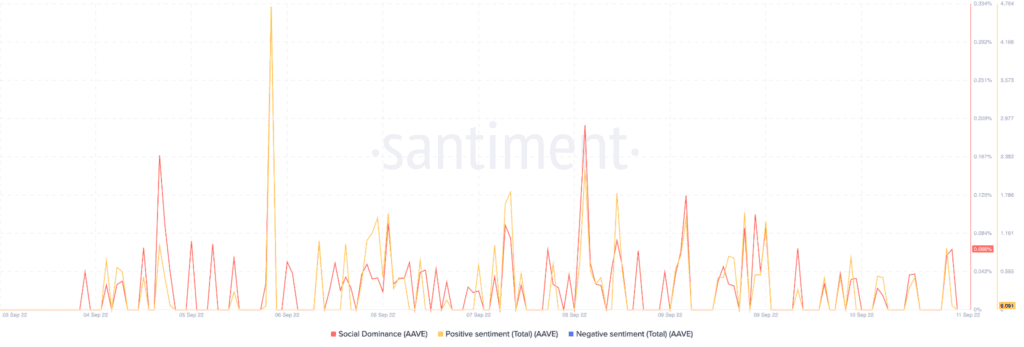

However, AAVE hasn’t been able to perform well in other aspects of social media, especially the social dominance aspect, since last week. Following a spike on the 6th of September, the social dominance of AAVE has been relatively low and there hasn’t been much hype around the token over the past few days.

Here are the pointers

Now, it is tough to put a pin on what the social media landscape looks like for AAVE at the moment. Worth noting, however, that the whales have been showing their interest for quite some time.

Addresses holding more than $1M have been on a steady rise over the last 3 months with a whopping 54.55% spike in the number of addresses holding that amount. AAVE’s outstanding market cap has also been on the rise, with the same hiking by around 64.76% in the last 3 months.

Even though there are a lot of factors in AAVE’s favor, the price of the token has gone down by 2.54% in the last 24 hours. The price has been fluctuating within the $94.36 resistance and the $78.66 support over the past few weeks.

The RSI seemed to be close to 50 and the CMF was close to 0, as both indicators were moving sideways. It would be safe to say that momentum isn’t with either the buyers or the sellers at the moment.

Although AAVE has several things going its way, its future still seems uncertain. Therefore, it is advised that readers do their research before getting into this trade.