AAVE has been trading at a significant discount from its all-time-high. However, its rally in the second half of March proved that it can still command healthy volumes.

AAVE rallied by close to 45% from its March-lows before undergoing a significant correction to its press time price levels.

AAVE was trading at $180, at the time of writing, after tanking by 25% over the last 7 days. In fact, this was a notable discount from its recent local high of $261.

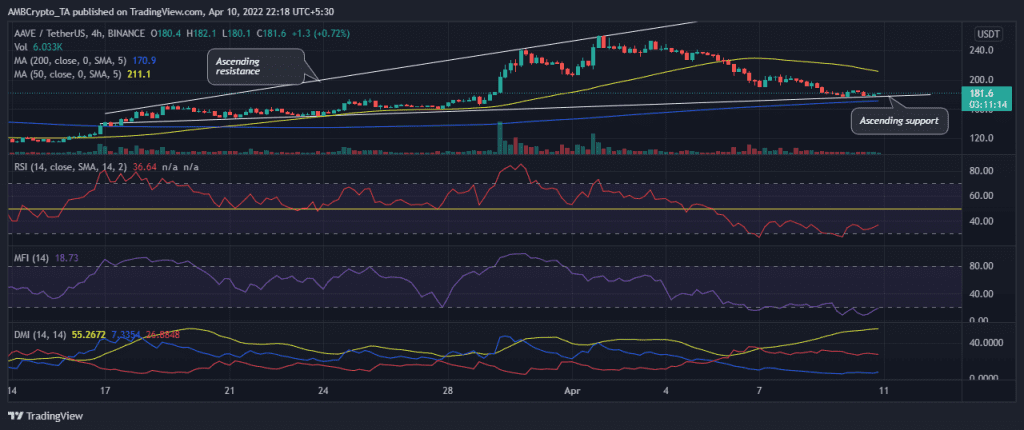

Interestingly, zooming out on its 4-hour chart revealed that it has been trading within a megaphone pattern since it crossed above its 50-day moving average. A support line underscored the price on the lower side while being restricted below an ascending resistance line.

AAVE’s price correction in the first week of April pushed it below its 50-day MA. It looks like the support line is holding up well since the price is likely to soon bounce back. Such recovery is supported by oversold conditions according to the RSI and the MFI during yesterday’s trading session.

In fact, the MFI revealed that there has been some accumulation over the last 24 hours.

Here, it’s worth pointing out that the DMI did not register a directional change on the 4-hour chart. This, although the +DI had already crossed above the –DI on the 1-hour chart.

A notable volume decline was also observed during the weekend. Contrary to its market cap registering an increase over the last 24 hours.

AAVE’s weighted sentiment also registered an uptick over the last 24 hours. While these metrics align with the current price performance, a look at exchange net flows might help paint a better picture of where the price is heading.

According to Glassnode’s exchange net position change metric, for instance, AAVE’s highest exchange outflows were seen in the first week of April.

What does it all mean for AAVE?

AAVE might be due for another run if the current support level holds strong. Higher exchange outflows and oversold conditions might pave the way for a supply shock that will lead to more upside.

However, it must be noted that there is still the risk of more downside in case of another unexpected major sell-off.