Bitcoin and the cryptocurrency market bounced back strongly last month in July after a severe correction during the second quarter. Trading currently at $23,300 levels, Bitcoin registered close to 20% gains last month.

However, the bigger question here is where is Bitcoin heading up from here onwards. On-chain data provider Santiment reports:

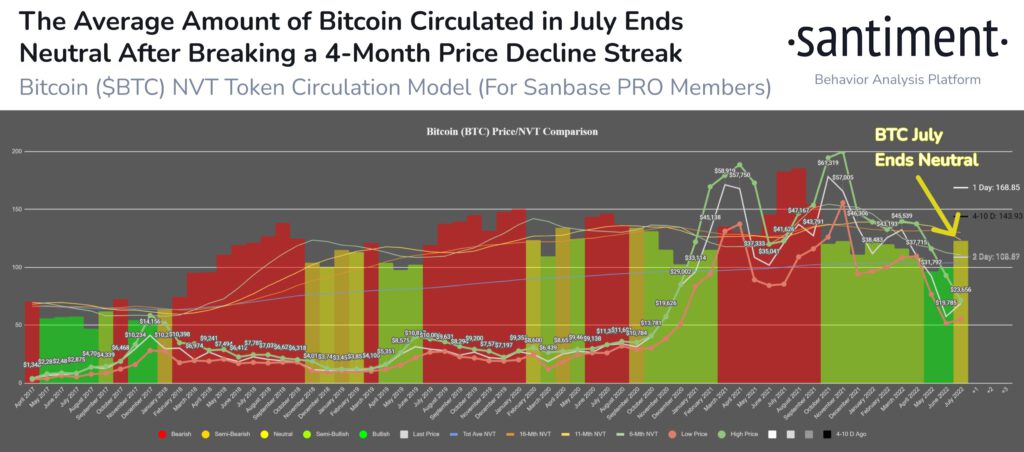

Bitcoin jumped +18% in July after @santimentfeed‘s NVT model’s growing #bullish divergence in May & June finally saw a price bounce come to fruition. With a neutral signal now as prices have risen and token circulation has declined slightly, August can move either direction.

On the other hand, Bloomberg’s senior commodity strategist Mike McGlone said that the risk-reward has considerably tilted in favor of Bitcoin. He wrote: “July marked the steepest discount in Bitcoin history to its 100-and 200-week moving averages, with implications for it to recover. I see risk vs. reward tilted favorably for one of the greatest bull markets in history”.

On the other hand, data from Glassnode also shows that the Bitcoin balance at the exchanges has been on a continuous decline. The BTC balance at the exchanges has now reached 12.6% of the total circulating supply.

Trending Stories

Equity vs Crypto Markets

Despite the Fed rate hike, the U.S. equity market performed strongly in July. Some market analysts are bullish that the market will continue to trend upwards from here onwards.

Nasdaq 100 putting in a bullish engulfing candle!

This could bode well for equities, and when equities do well so does #crypto! pic.twitter.com/4aSvGuDWob

— Lark Davis (@TheCryptoLark) August 1, 2022

Of course, as the equity market takes off, crypto will follow them on similar lines. The world’s second-largest crypto Ethereum (ETH) rallied more than 60% last month from its bottom. The recent price rally in ETH has once again sparked the debate of Ethereum flippening Bitcoin. As of press time, ETH is trading close to $1,700 levels.

Other altcoins like XRP, Polygon (MATIC), Solana (SOL), Avalanche (AVAX) have gained an upward momentum last month. If the broader market supports, the momentum can continue this month as well.