A new price all-time high has been on MATIC’s cards for almost two months now but the $2.7 level has been unachievable for the altcoin even amid high anticipation of a new ATH by the market participants. Interestingly, over the last week MATIC missed another shot towards an ATH even though the larger setup for the coin seemed hyper-bullish as the larger market consolidated.

Now, at the time of writing as Polygon’s native token MATIC oscillated at $2.06, down almost 17% from its multi-month price high of $2.57 made last week, where did the altcoin stand?

Hope still on the horizon

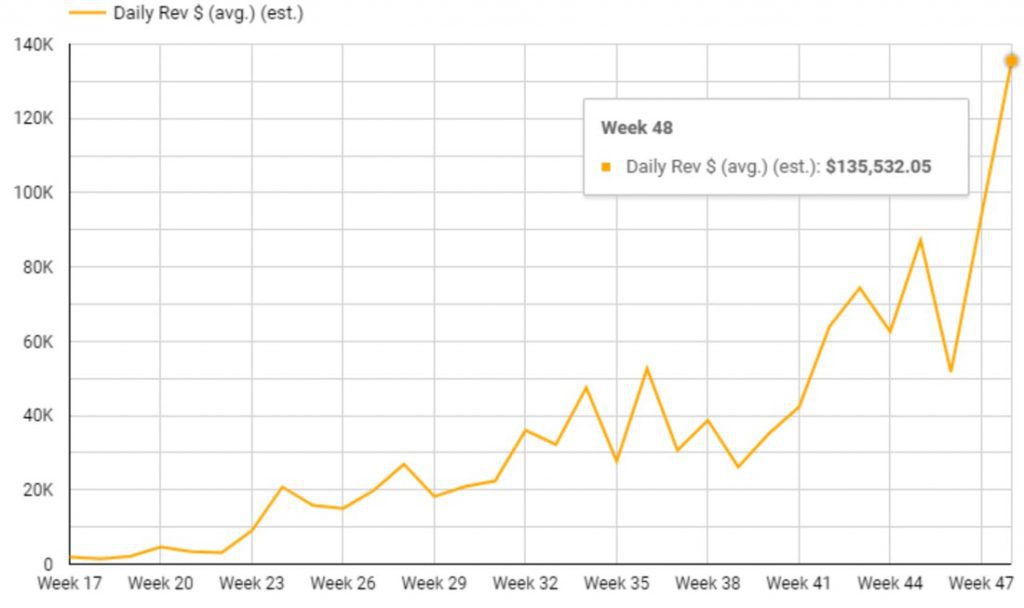

While the alt’s price just missed ATH levels, Polygon PoS was setting new ATHs in network revenue for almost four weeks. Revenues increased by 44% to $136K per day in USD. While the average cost per transaction last week was $0.035 and average transaction prices have grown 53% month over month.

That being said, Polygon PoS user base presented a steady growth as over the last week, daily active users (DAUs) reached 354K, up by almost 4%. This was 61.29% of the active user base of Ethereum.

This continual growth could be driven by sustained cohort sizes and improving retention metrics across the various cohorts. Notably, Polygon routinely onboard more than 250k new users a week with an average cohort size of 347K last month. Thus, while the network looked stable and ready to boom, what kept prices at bay?

Here’s whats missing…

With choppy price action, the network seems to be making attempts to come back as Polygon recently announced the acquisition of Mir, a startup building ZK tech, at $400 million. However, MATIC’s price still made lower lows as the asset lost over 10% in the last couple of days.

Looking at MATIC’s short and mid short term MVRVs still falling, it seemed like the lower danger zone levels hadn’t yet been reached leaving more scope for the alt to fall in the near term. Price-wise, MATIC’s struggle in the short-term could continue.

Further, while the long-term growth still looked intact, MATIC now lacked the institutional support it saw in June 2021 when its TVL reached the $10 billion mark. Since then the altcoin’s TVL has fallen by over 50% and currently stands at $4.84, the TVL hasn’t moved much for the last two months.

The recent MATIC rally saw a lack of retail euphoria noticeable in the low trade volumes in comparison to the May rally, as well as, low institutional interest (seen in the stagnant TVL growth) which could have been behind MATIC’s tussle to make a new ATH.