Today, Cardano leads the pack in gains amongst the top ten crypto assets by market cap. The Cardano community has extended their unfazed support for the protocol. One highly popular, pseudonymous Cardano whale published a Twitter thread for potential investors who weren’t sure about Cardano.

Fair to say this got the community excited about Cardano’s long-term prospects.

3/Why was Cardano “slow to market”? It wasn’t

Many others are BFT (Tendermint etc) while in Cardano a novel Nakamoto consensus L1 PoS was coded from ground up by cryptographers & academics

There are security, decentralisation and scalability implications you should understand pic.twitter.com/rHAG6315ue

— ADA whale (@cardano_whale) March 15, 2022

ADA recorded a fresh 4% surge as it traded shy of the $1 mark.

Is it “special”?

Cardano saw an impressive run in 2021-22 in terms of staking.

23 new Cardano ($ADA) pools staked about 1.5 billion ADA ($1.4 B) in the last 24 hours. This increased the cryptocurrency’s total supply staked to around 74%. Cardano staking pool analytics platform (pool.pm), in a series of tweets on 22 March, highlighted this development.

23 new #Cardano pools with more than 62M₳ stake each have been created during the last 12 hours, increasing by about 1.5 billion $ADA the total staked, now close to 74%.

See the last whale delegations here:https://t.co/XiAOim2GO4

Pools names seem based on famous scientists. pic.twitter.com/U9S5saqSEq

— pool.pm (@pool_pm) March 22, 2022

The tweet added that each staking pool possessed more than 60 million Cardano staked, had over 5% margin, 0₳ pledge, and usually two whale sharks with more than 30 million staked. Such a large amount potentially indicated an increased interest from more significant market players and corporations.

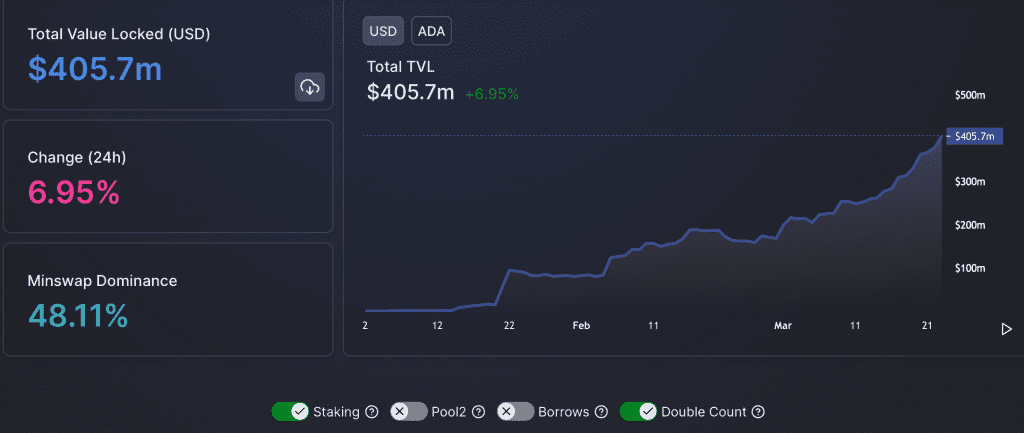

Also, Cardano’s decentralized finance ecosystem surged at a rapid pace. According to data provided by cryptocurrency analytics firm DeFiLama, the total value locked (TVL) in the protocol surpassed the $400 million mark.

Source: DefiLama

Minswap, a community-driven multi-pool decentralized exchange, accounted for 63.07% of the sum above. Not just this, the eighth largest token even locked horns with cryptocurrency giants such as Bitcoin, Ethereum.

On 21 March, the cryptocurrency had a 24-hour USD transaction volume of $68.76 billion. This was four times or 332.45% higher than Bitcoin’s $15.90 billion and even crossed Ethereum’s $3.63 billion (nearly 20x).

Cardano 24H transaction volume is 68.76B

That’s 3.5x more than Bitcoin and Ethereum..

combined..

👀https://t.co/fZkxYWOGXK#Cardano #DeFi #RealFihttps://t.co/rnmuKpRvB3 pic.twitter.com/Clzoib238J

— CRCI (@crcindex) March 21, 2022

Any surprises here?

The milestones achieved doesn’t come as a total surprise. The Ecosystem would continue to grow ahead of the scheduled hard fork, the Vasil hard fork, somewhere in June 2022

Coming with the Vasil hardforkhttps://t.co/tmnrPhJWE6 this blog explains pipelining

— Charles Hoskinson (@IOHK_Charles) March 22, 2022

Cardano’s researcher Matthias Fitzi explained the concept in a post published on the company’s blog on 21 March. In the post, Fitzi said that “the recent enabling of smart contracts on Cardano has led to a significant increase in user activity” and the growth of “average transaction sizes.”

Cardano also witnessed significant gains over the past seven days. At press time, its price stood at $0.98, 22.5% more than seven days before, when it traded at $0.80.