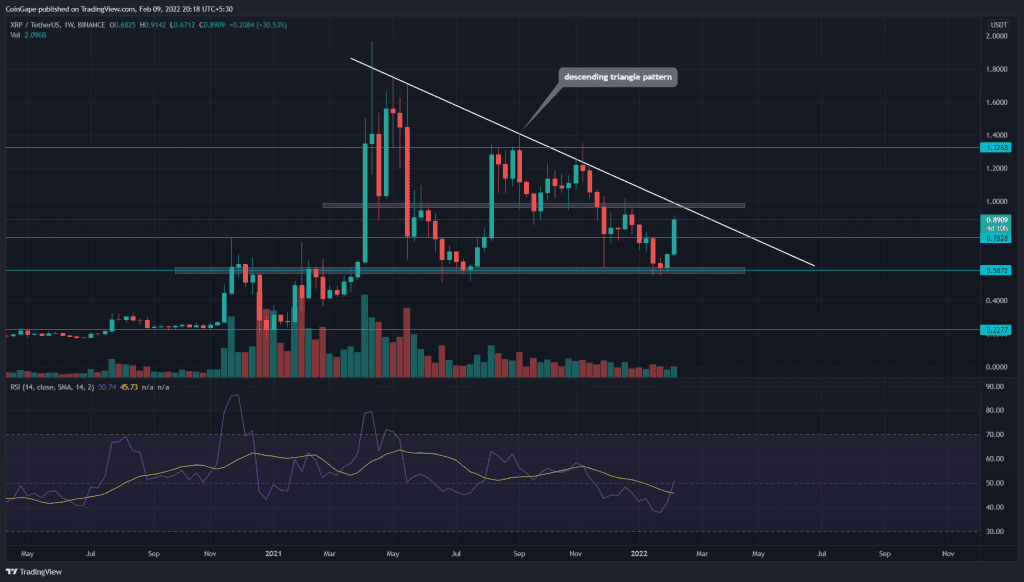

The XRP/USDT pair has gained 50% since last week. The seven consecutive green candles in the technical chart indicate strong bullish momentum. However, the bears maintaining stiff resistance at the $1 mark will confirm if buyers are ready for a bullish rally.

Key technical points

- The XRP buyers trying to retake 20-and-50 weekly EMA

- The weekly-RSI chart entering the bullish territory

- The intraday trading volume in the XRP is $6 Billion, indicating a 105% gain.

Source- Tradingview

On February 4th, the XRP price rebounded from the yearly support of $0.6, with a weekly-morning star candle pattern. XRP vs SEC case approaching closure has helped to bolster the upcoming rally and breached the $0.8 resistance.

XRP price gradually continued to move up and is currently trading at the $0.88 mark. Furthermore, the XRP technical chart shows a descending triangle pattern, and the coin price is nearing the confluence resistance of the pattern’s resistance trendline and $1 psychological level.

If XRP price respects this chart pattern, the sellers would reject the coin from the $1 mark and slide it back to $0.6 support.

However, the recent price jump has surged the weekly Relative strength index(50) above the 14-SMA line and is currently knocking on the midline door.

XRP Bulls Plunge Above The Resistance Trendline

Source- Tradingview

Even though the XRP price is under the influence of a major bearish pattern, the recent price action accentuates the bull power. As highlighted in the recent tweet by Cryptoes, the altcoin price provided a daily-candle closing above the shared resistance of a long coming trendline and 200-day EMA.

Therefore, the price range between the $1 and 200 EMA can be considered a no-trading zone. A smart trader would avoid the conflict between these crucial technical levels and wait for a confirmation for one party overpowering the other.

A decisive breakout and closing beyond the mentioned levels should signal the entry opportunity with the following trend.

- Resistance levels- $1 and $1.32

- Support levels- 200-day EMA, $0.786