In its 10 November publication, Algorand [ALGO] announced that it was working towards healthier security for its core protocol. However, the self-titled “most powerful” blockchain noted that it was not alone in the pursuit. According to the release, it was offering to partner with developers and Immunefi, a web3 bug bounty platform.

Read AMBCrypto’s Price Prediction for Algorand 2023-2024

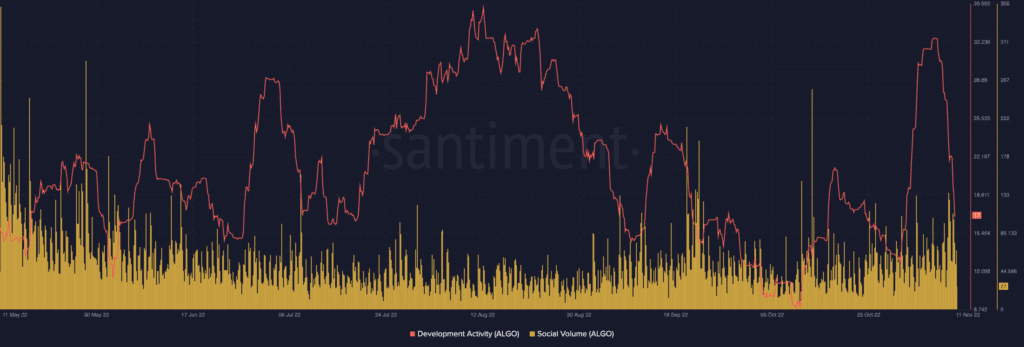

Interestingly, one would have assumed that the development activity of Algorand would take a better turn. However, on-chain data revealed that was not the plight.

Will ALGO need a liberator?

According to Santiment, Algorand’s development activity was 17 at press time. Before now, the same metric was as high as 32.45 on 7 November.

This decrease implied that the Algorand team might have eased a bit on upgrade commitments. In addition, less testing has been happening due to this obvious development downturn.

Additionally, the social volume was not any better. With its value declining to 27, it meant that Algorand was not part of the top cryptocurrencies that expanded its influence across the crypto community lately.

The status of the metric above might have left investors in bewilderment. This was because Algorand was one of the assets with links to the fast-approaching world cup. Hence, it could have been expected that it performed better per social metrics.

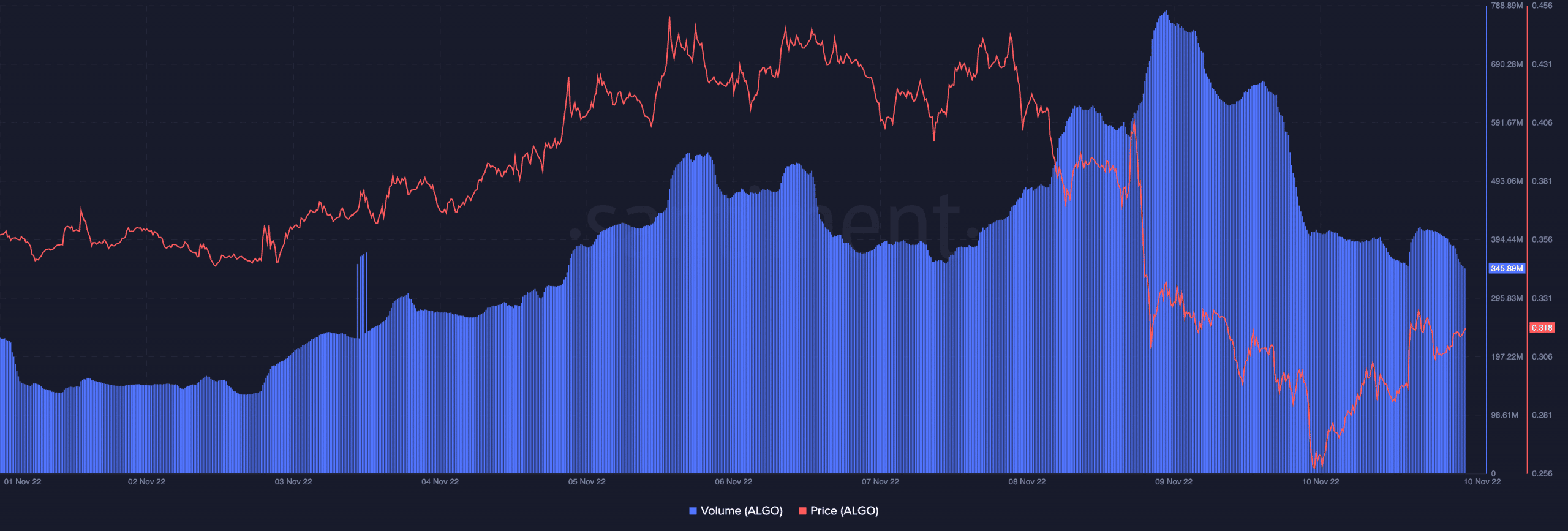

Despite that, ALGO seemed to have made for the fall with its price. Data from price tracking platform, CoinMarketCap showed that ALGO increased 7.59% in the last 24 hours.

While it traded at $0.311, it was not much of a positive impact for its volume. According to Santiment, the Algorand volume had lost 10.09% of its value.

This implied that the amount of ALGO that has passed through confirmed transactions over the last day was minimal when compared to the day before.

It’s no space for abundance

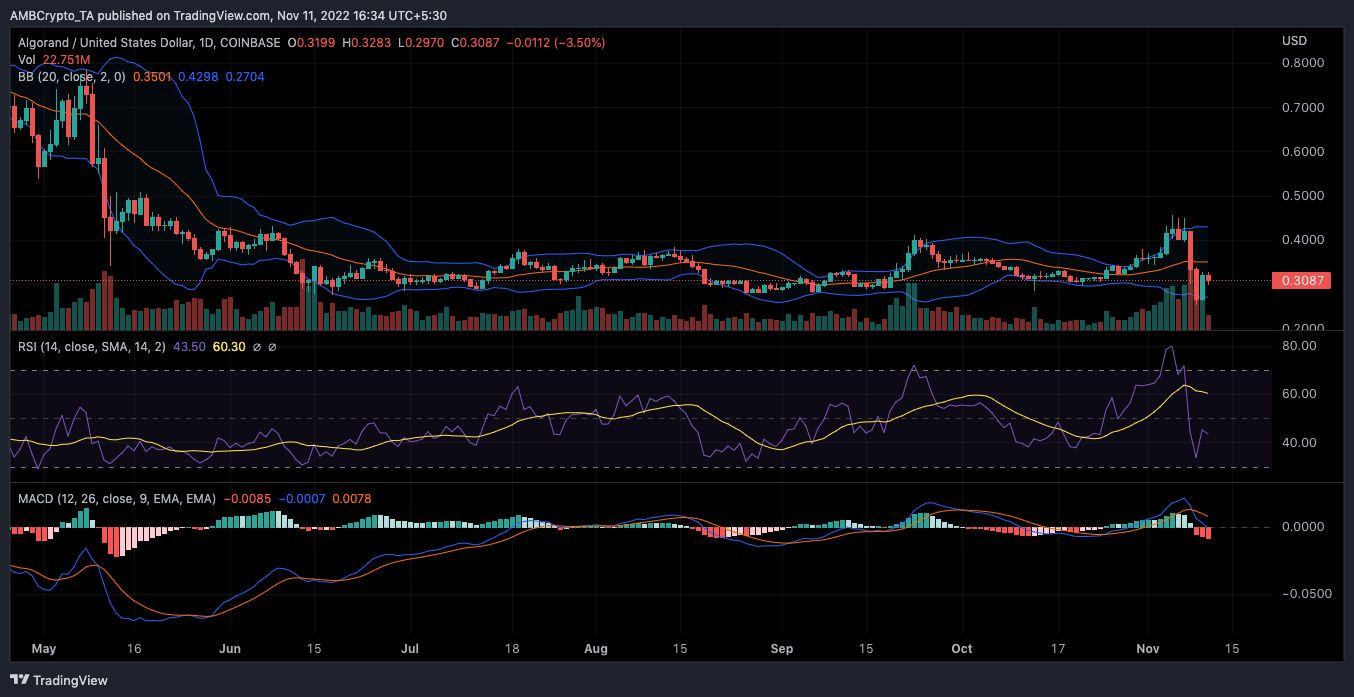

On the daily chart, ALGO was not at the top of the market. This was due to the indications revealed by the Relative Strength Index (RSI).

According to the RSI, ALGO recently exited an overbought zone at 77.41 on 5 November. While it seemed to have revived from its selling pressure at 43.50, there was no good grounds to prove that it had gained control of the buying zone.

Hence, ALGO could remain in the $0.31 region it was trading at, as of this writing.

Furthermore, the Moving Average Convergence Divergence (MACD) supported more of a bearish momentum. At press time, the sellers’ strength (orange) maintained its spot above the buyers (blue).

In addition the 12 to 26 EMA difference, was positioned below the zero-point histogram at -0.0085. In circumstances like this, ALGO could go bearish after its recent rally. However, it could be wise to consider the increasing volatility indicated by the Bollinger Bands before taking a stance.