The month of February, despite being highly volatile, turned out to be not so damaging in the case of Solana. The overall gains and losses canceled each other out by February 28 after the 20% rally, and the month’s total changes stood at 0.13%.

But when it comes to investor performance, Solana outperformed pretty much every major altcoin.

Solana over Ethereum

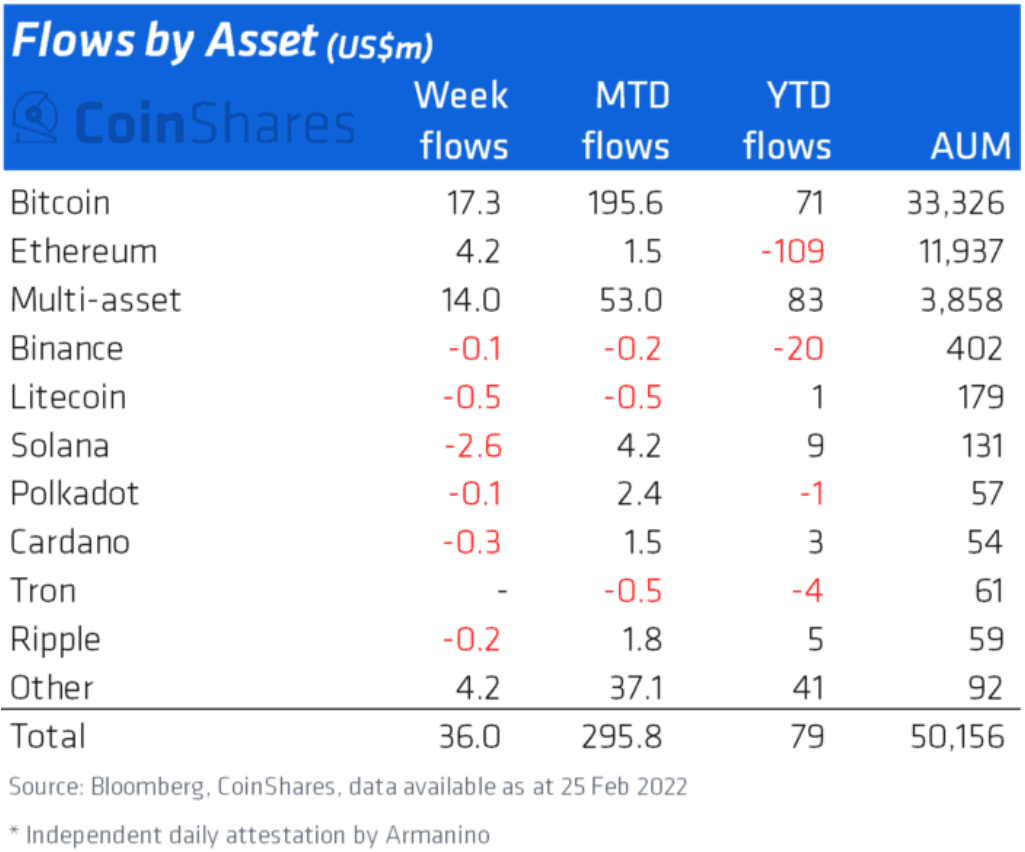

Data from CoinShares indicated that except for Bitcoin, no other cryptocurrency could register inflows more than $10 million. Many couldn’t even register inflows at all. Binance, Polkadot, Tron noted month-to-date outflows worth $20 million, $1 million, and $4 million, respectively.

However, leading this pack was the altcoin king Ethereum marking $109 million worth of outflows. As a matter of fact, Ethereum’s outflows were higher than Bitcoin’s inflows.

Solana leads monthly inflows as well as weekly outflows | Source: CoinShares

On the other hand, Solana brought in about $9 million by the end of the month. This, despite the altcoin leading February last week’s outflows at $2.6 million. But, February wasn’t entirely great for Solana. Apart from the market’s volatility, Solana’s NFT front also witnessed significant damage.

While NFT transactions started strong at the beginning of the month, halfway through February, the figures sank.

MagicEden, the leading Solana NFT marketplace, observed an 81% fall in NFT transactions while other marketplaces continued at their pace.

Solana NFT transactions this month | Source: Dune – AMBCrypto

By the end of February, transactions reduced to just 19k NFTs a day from a monthly high of 312k.

Even so, there is some prospect of Solana investors enjoying a good March given the recent social boost from Gemini. One of the top-10 crypto exchanges in the world, Gemini announced yesterday that the exchange had added support for Solana against all major fiat pairs.

1/2 Incoming: @solana $SOL is now supported for deposits and can be custodied in a Gemini exchange wallet. Welcome #SOL!🚀 https://t.co/s4QcYuFtSu

— Gemini (@Gemini) February 28, 2022

Solana is already the eighth-biggest cryptocurrency and the sixth-biggest DeFi chain. And, with the coin trading at around $104.66 at press time, up by 16% from yesterday, it might just continue its rapid pace of growth.

Solana price action | Source: TradingView – AMBCrypto