Do you like anime merch? If you do, you’re certainly not a minority, as a new anime-inspired NFT collection has been grabbing eyeballs across the industry. Is it a one-off event or does it say something more about the trajectory of the NFT sector as a whole?

Let’s find out.

All according to keikaku

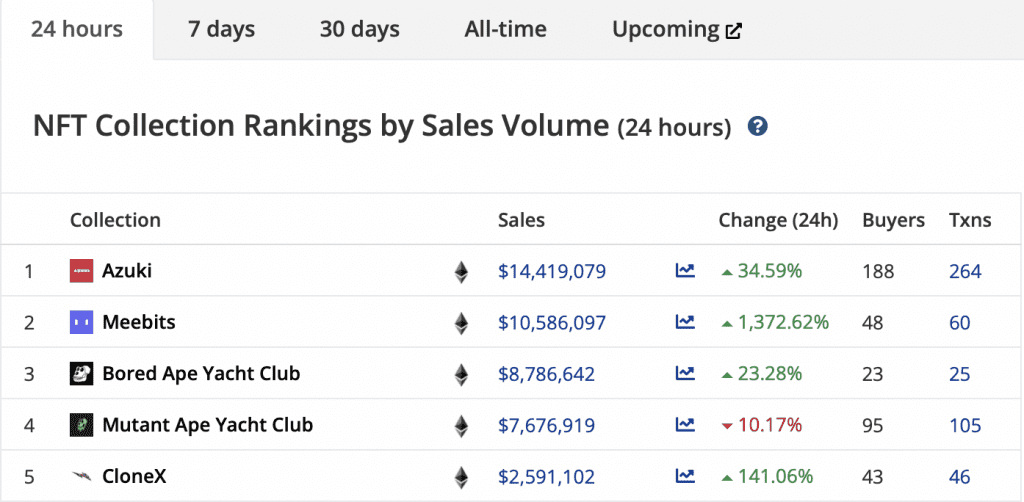

At press time, an NFT collection of 10,000 avatars with characters strongly reminiscent of anime characters was sitting at the top of Crypto Slam’s list of top NFT collections by 24-hour sales volume. With sales of over $14 million, Azuki jumped by 34.59% in a day and rallied by 285.43% in a week. This put it above strong contenders like Meebits and even industry giants like BAYC and MAYC.

What’s more, this was in spite of Meebits surging by 1,372.62% in the past 24 hours. An impressive feat indeed.

Source: Cryptoslam.io

However, users should note that Azuki has fallen by 69.30% in the past month.

So what’s the takeaway here? Well, it turns out there are some major changes taking place behind the scenes of the NFT market.

Are Udon pumping?

NFT trades volume has been on a downtrend since late January, but 15 March saw a gigantic spike with volumes going over $300 million. It’s curious to note that Azuki’s price also jumped shortly before this occurrence. After some consolidation and correction, it is again rallying – even as NFT trade volumes rise with it.

Source: Santiment

That being said, it is premature to assume that the NFT market is reaching never before seen highs. Dune Analytics’s data for OpenSea [Ethereum] revealed that March monthly volumes were yet to touch $2 billion at press time.

Compare this to monthly volumes in January 2022, which came close to $5 billion. All in all, it seems that the NFT industry has some work to do if it hopes to scale new heights.

Source: Dune Analytics

Just Google it

A few days earlier, traders were discussing whether the NFT market was on its way down. The reason? Google Trends revealed that interest in “NFT” and related keywords had fallen and many took it as a sign that the industry itself was flailing.

At press time, however, data showed that interest in the term was slightly on the rise once more.