The cryptocurrency market continued to slide over the weekend as expectations of an early rate hike from the Federal Reserve hurt investor sentiment. Bitcoin, the largest cryptocurrency by market capitalization witnessed a significant fall. However, at press time, BTC surged by 3% in 24 hours and it was trading above the $43k mark. Nonetheless, with the BTC facing bears, it has become a common sight to see investors and traders sell.

But, the pertinent question here is- Has everyone given up on Bitcoin already?

BTC till the end

Well, Bitcoin enthusiasts still support the king coin despite the complaints. Hong Fang, the CEO of popular cryptocurrency exchange OKCoin recently spoke at a CNBC interview. She believes it’s “reasonable” for the price of the flagship cryptocurrency to hit $100,000 in the long run. What’s more, investors, of late, have been a little skeptical of Bitcoin. In this regard, Fang opined that the Bitcoin network has “no protocol risk” and that as long as it is maintained she is “very bullish in the asset itself.”

“I still believe that the $100,000 price point is reasonable, but the timing can be a bit elusive because we are at the mercy of market dynamics,” she added.

Well, short-term narrative always has a blurry line attached to it. This is no different. Even here, she touched upon such hiccups that are bound to appear in BTC’s short-term trajectory. The CEO noted that in the short-term:

“…leveraged products and derivatives may heavily influence the price of the flagship cryptocurrency while other assets will be competing for capital within the crypto space.”

Nevertheless, she remains undeterred on her bullish pitch for Bitcoin. It also echoed PlanB’s S2F model projection of $100k. Now whether Bitcoin will achieve this or not is a entirely different story.

Not-so-high hopes

Seba Bank CEO Guido Buehler shared his bank’s prediction on where the price of Bitcoin is heading with CNBC at the Crypto Finance Conference. Regarding the price of Bitcoin this year, he said:

“We believe the price is going up. Our internal valuation model indicates a price right now between $50,000 and $75,000.”

He further noted, “I’m quite confident we are going to see that level. The question is always timing,” he noted. Well, Seba Bank is a digital assets banking platform licensed by the Swiss Financial Market Supervisory Authority (FINMA).

One of the obvious reasons is institutional investors.

“Institutional money will probably drive the price up. We are working as a fully regulated bank at Seba. We have asset pools that are looking for the right time to invest,” Buehler asserted.

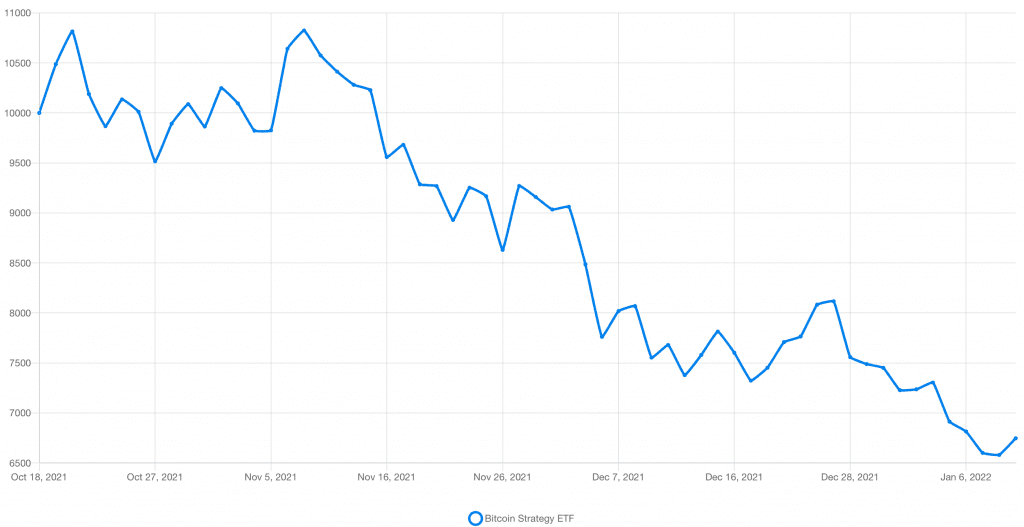

Having said that, here are some facts. Bitcoin has suffered on a massive scale and as a result interest in the flagship cryptocurrency took a hit as well. For instance, post a stellar launch, interest waned in the ProShares Bitcoin Strategy Exchange Traded Fund (BITO) which now has the lowest amount of CME contracts since November 2021.

Source: BITO