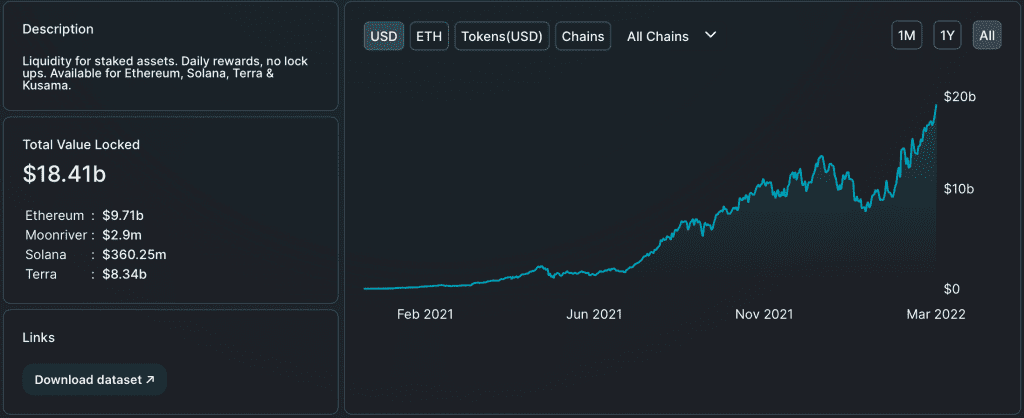

Despite a plunge in the total value locked in decentralized finance in 2022, Lido Finance continues to see a spike in TVL since 1 March, 2022. It achieved one milestone after the other as the year progressed. In fact, since the starting of this month, the protocol gained 18% in total value locked.

On that day, Lido had a TVL of $13.83 billion, and this rose to approximately $16.43 billion on 23 March, 2022.

Following this up-trend

On 29 March, Lido Finance (LDO), the liquidity staking protocol, saw the TVL stat cross the $18 billion mark. As per DeFiLama, the number stood at $18.45 billion. The increase in the number of tokens staked saw the dApp surpass most other competitors.

Source: DeFiLama

It exceeded other decentralized protocols such as MakerDAO, Anchor (ANC), Aave (AAVE), Convex Finance (CVX), Uniswap (UNI), etc. Although, it was placed just behind Curve (CRV) in the total value locked rankings. Post an hour, the flagship DeFi platform ranked at the first spot, as evident in the table below.

Lido was launched as an ERC20 token and became a part of the Ethereum ecosystem in 2020. As a result, Lido has experienced substantial growth in total value locked in less than two years. The current success Lido enjoyed came from an increase in the number of coins staked in its protocols on the Ethereum Network, Terra, and Solana.

On 23 March, the total value locked of Lido on Ethereum was $8.3 billion, the TVL of Lido on Solana was $297.76 million, and the value locked on Terra was $7.83 billion. At the time of writing, the metric was up by 20%.

Different catalysts played a vital role in this unprecedented success. For instance, Three Arrows Capital infused approximately $22.43 million, the equivalent of 7,500 ETH from FTX and Deribit.

The Three Arrows Capital address (0x4862733B5FdDFd35f35ea8CCf08F5045e57388B3) has inflowed 7,500 ETH in the past seven hours, with a total value of about $22.43m; of which 5,500 ETH was withdrawn from FTX and 2,000 ETH was withdrawn from Deribit. https://t.co/27A1u6o4su

— Wu Blockchain (@WuBlockchain) March 22, 2022

On the same day, through a third-party Ether wallet, the “Curve stETH pool” on Lido received 36,401 ETH worth approximately $110 million from Three Arrows Capital. ‘Stakers’ enjoyed a profit margin with some witnessing 30%+ yield on leveraged stSOL positions.

Why not me?

Source: DeFiLama

Other protocols, for instance, Maker DAO, didn’t quite reciprocate the scenario. It didn’t enjoy the potential liquidity as it launched Ethereum as an ERC20 token. At the same time, some want liquidity from a broad range of investors on several blockchain networks too.