Earlier this week, the Bitcoin (BTC) price rallied to $44,000 levels amid sanctions reports. But, the cryptocurrency market slumped again as new development from the Ukrainian conflict came in. At press time, the entire crypto market was down by 4%. The king coin suffered a 5% price correction as it dropped below the $41,500 mark.

There’s no rush

The percentage of the Bitcoin supply on exchanges dipped further down to 10.76% on 4 March as the supply shock continued to deepen. As pointed out by Santiment, the percentage of BTC supply stored on exchanges dropped over the past 30 days. Moreover, the decreasing supply of BTC held on exchanges essentially meant that investors weren’t in a rush to sell their coins. This can be considered a bullish sign.

Moreover, Tether USD or USDT’s supply on exchanges shared the same fate.

📉 The respective supplies of both #Bitcoin and #Tether have fallen the past 30 days. For $BTC, this has been the norm for a while. For $USDT, though, this fall began at the start of February. It’s something to watch as a signal for a push back above $45k. https://t.co/3e0EP1hI6F pic.twitter.com/4YJrd2Mam6

— Santiment (@santimentfeed) March 4, 2022

While this is a strong sign of market recovery based on buying pressure, it is imperative to evaluate other variables as well.

Different name, same aim

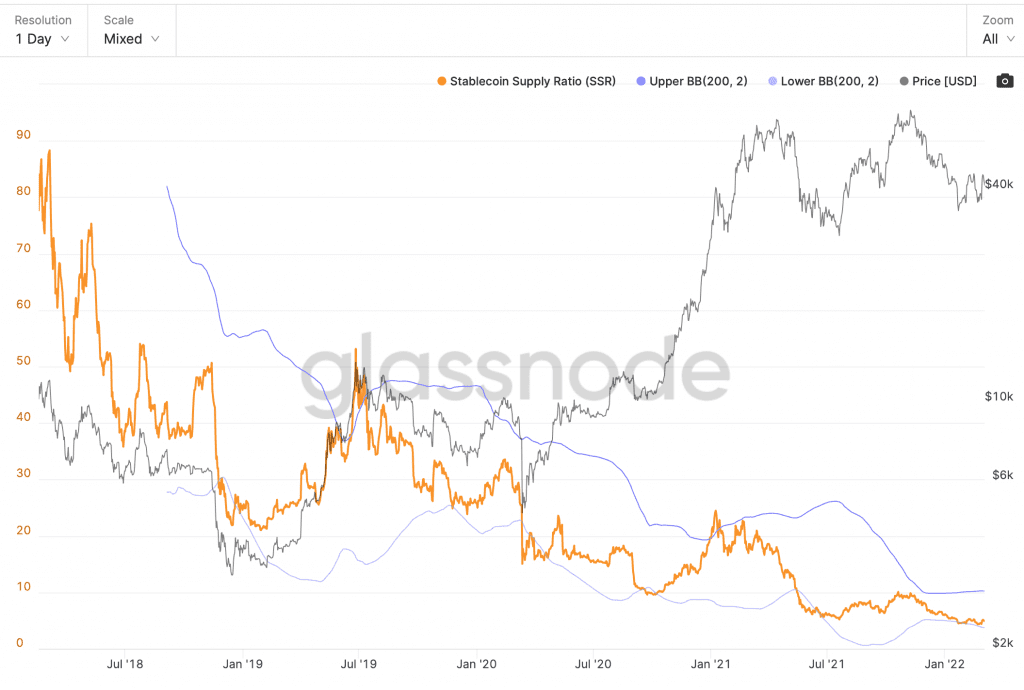

The stablecoin Supply Ratio or SSR is the ratio between Bitcoin supply and the supply of stablecoins denoted in BTC. Whenever the SSR ratio is low, it usually indicates that the buying power is residing with stablecoins to acquire more Bitcoin.

In the above chart, the SSR ratio was at a high value during the early half of 2021. But since then, it receded. After reaching a low a year later, it witnessed a change in the supply/demand dynamic. At the time of writing, the SSR stood at 5.09.

Interestingly, SSR portrayed a bullish narrative. The upside came amid fresh buy-side momentum. It fundamentally got the fuel from the spotlight shone on crypto. Especially amid donations to Ukraine.

Thanks to Plan B

Investors of late have been having more faith in BTC. Well, a Swiss connection has played a major role here. Cryptocurrencies including Bitcoin and Tether were made de facto legal tender in Lugano, Switzerland, as the city aimed to become a regional crypto hub. The announcement was made by city director Pietro Poretti in a live-streamed event called “Lugano’s Plan ₿” on 3 March.

Crypto analyst Scott Melker opined that Bitcoin’s retest of $42k was critical. Flipping the major downtrend line into support would be even better.

There is the highly anticipated retest of 42K, to the dollar.

Let’s see if it holds. pic.twitter.com/uuBt83s1SJ

— The Wolf Of All Streets (@scottmelker) March 3, 2022

IntoTheBlock data shared by crypto analyst Ali Martinez showed the two main price levels for BTC short term. The $45,000 area represented the key resistance zone while $40,000 offered the main anchor to the downside.

The IOMAP by @intotheblock paints a clear picture for #Bitcoin.

The most significant support for $BTC sits at $40,500 while the most significant resistance sits at $45,000. Breaking support could push #BTC to $37,000 while breaking resistance will send it to $49,000. pic.twitter.com/hhLrOr7pYL

— Ali Martinez (@ali_charts) March 3, 2022

If bears breached the $40,00 level, BTC could go to $37,000 or lower.