Avalanche [AVAX] announced a new collaboration with GMX_io for its liquidity mining incentive program called Avalanche Rush. Despite multiple attempts to generate interest in Avalanche’s DeFi ecosystem, its TVL continued to decline.

@GMX_io allows for deep liquidity with its $GLP token, a liquidity provider token allowing LPs to earn fees from trading.

Currently, there is over $60 million in $GLP staked 🔒

Learn more about GMX and #Avalanche Rush ⬇️https://t.co/rOjNvSSh69

— Avalanche 🔺 (@avalancheavax) November 7, 2022

____________________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Avalanche [AVAX] for 2022-2023

____________________________________________________________________________________________

What’s the “Rush”?

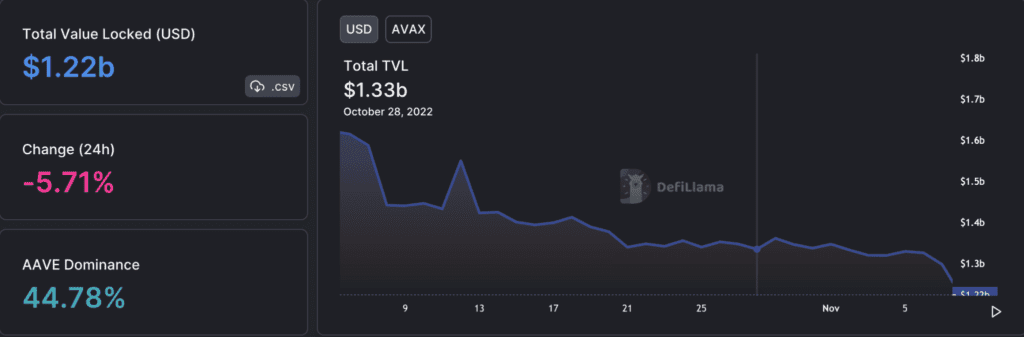

As can be seen from the image below, Avalanche‘s TVL continued to decline over the past 30 days, from $1.62 billion to $1.22 billion in the last month. Avalanche’s TVL depreciated by 5.71% over the last 24 hours according to data provided by DefiLlama.

Popular dApps on the Avalanche network didn’t have a positive week as well. Prevalent dApps such as Trader Joe and Benqi observed a decline in terms of unique active users, according to DappRadar. The number of unique active users for Trader Joe declined by 23.34% over the last week. Furthermore, the number of unique active users for Benqi depreciated by 60.46% over the last week as well.

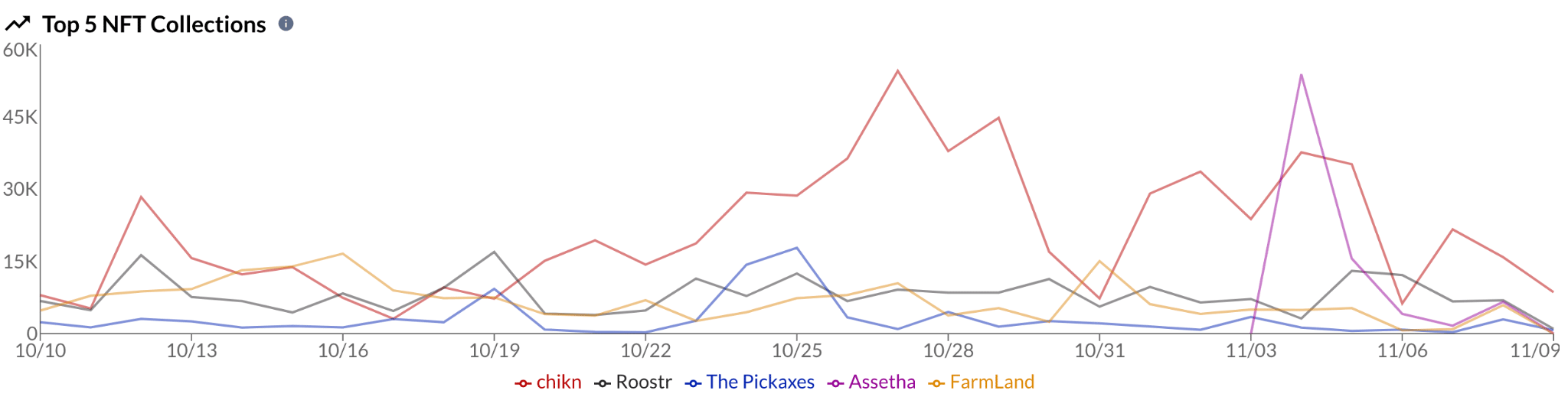

Along with the decline in dApp activity, the interest around blue chip Avalanche NFTs depreciated as well. As can be seen from the image below, the top five NFT collections on the Avalanche network declined in terms of volume over the past few days.

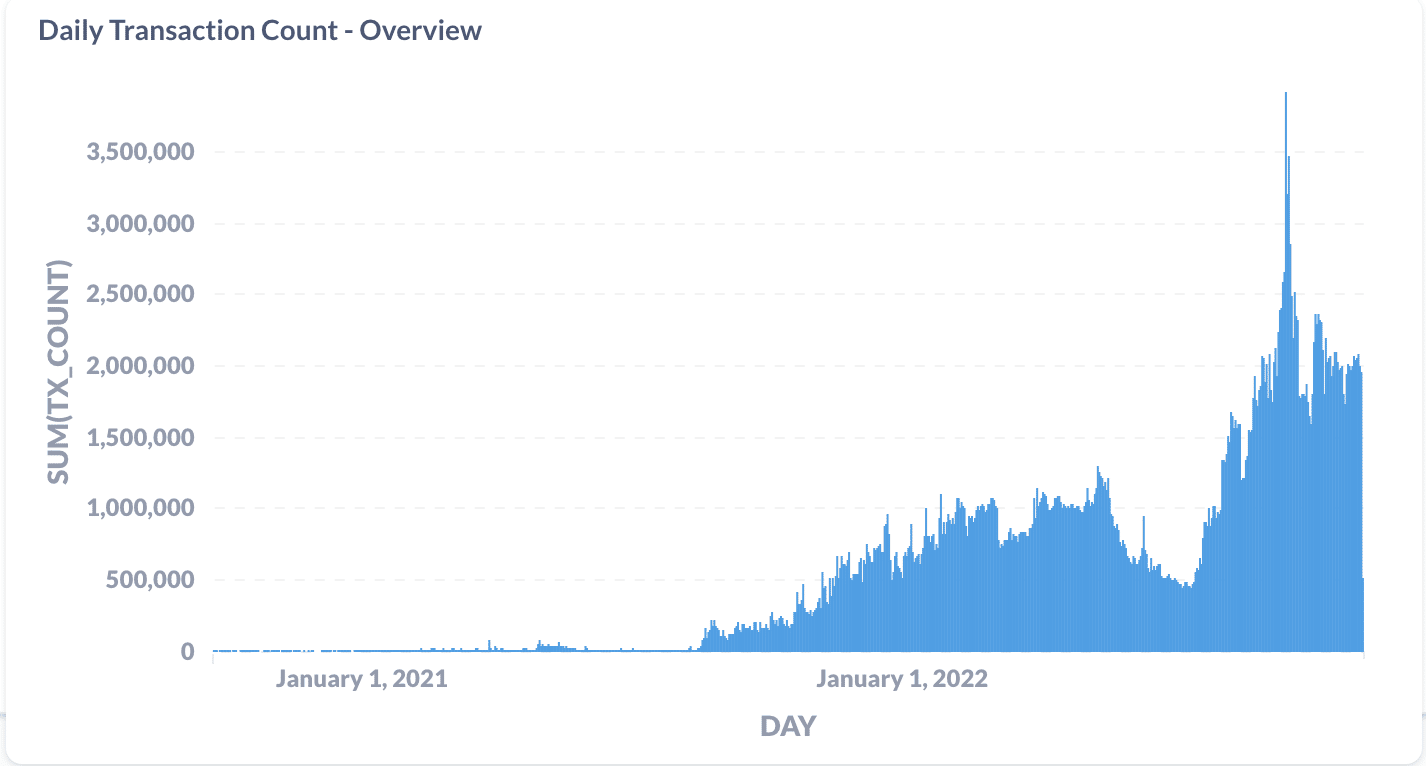

The daily transaction count for Avalanche depreciated over the past few months as well. From 3.9 million daily transactions in September, the number of transactions fell to 2 million at the time of press.

However, a spike in monthly active users was seen as the number of monthly active users reached a four-month high of 538,000.

At the time of writing, AVAX was trading at 16.64 and had depreciated by 10.07% in the last seven days. Additionally, as per data from Messari, its market cap dominance depreciated by 6.51% during the same period. At press time, AVAX had captured 0.56% of the overall crypto market.

However, Avalanche’s volume continued to grow and appreciated by 80% in the last 24 hours.