Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

Ranked 93 on CoinMarketCap, Anchor Protocol has a market capitalization of $852.4 million. The lending and borrowing protocol’s token has appreciated by nearly 30% from the $2.41 lows to trade at $3 at the time of writing. Has Anchor found the bottom at $2.4, and will it continue to rise in the weeks to come?

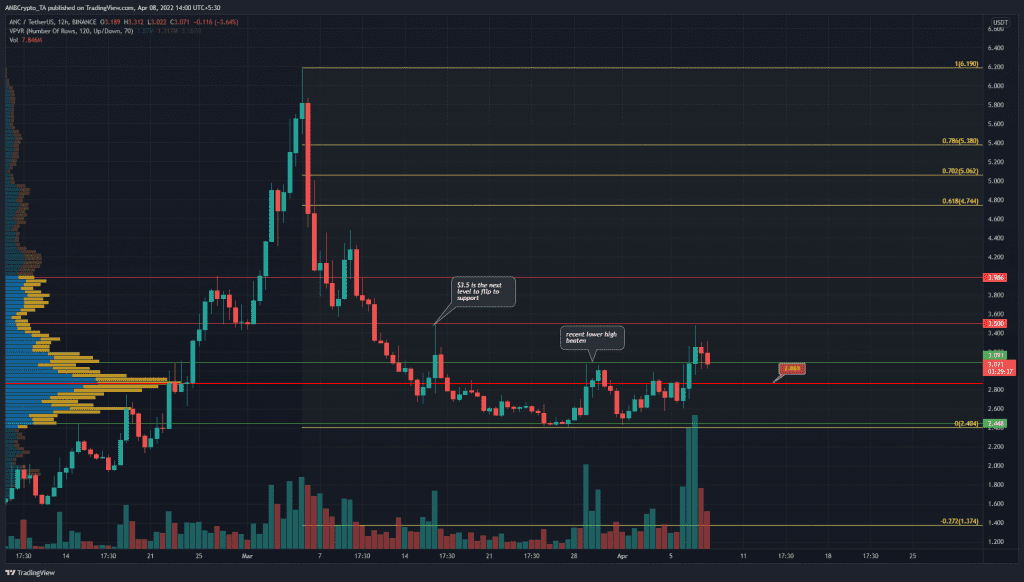

ANC- 12H

The coin dropped to $2.4 in March, from the highs at $6.19. Based on this move, a set of Fibonacci retracement levels (yellow) was plotted. In the next few weeks, if ANC can climb past $3.5, it was likely that the coin would push toward the $4.75-$5.38 area.

Market participants with a focus on higher timeframes might begin to enter short positions in this area, hence it can be used to take profits on long positions from around $2.8-$3.

The Visible Range Volume Profile showed the Point of Control to be at $2.88, and the price has climbed past this level in the past few days. Moreover, a move past the $3 level combined with the price registering a higher low at $2.6 showed that some bullishness could be seen for ANC.

Rationale

The RSI has been climbing higher in the past two weeks, and broke past the neutral 50 as well as flipped it to support. At press time, the RSI stood at 56.88 to show strong bullish momentum. The AO has also risen past the zero line and continued to climb higher.

The Cumulative Volume Delta was green for the past week to show buying pressure was greater, and the OBV has also been rising to show steady buying volume. Moreover, the OBV has been on an uptrend going back to mid-February.

Conclusion

The higher timeframe indicators had flipped to bullish and showed the demand arriving in the market. It was possible that ANC could dip to the POC at $2.88. The $2.85-$3.07 area presented longer-term investors a buying opportunity, targeting $3.5, $4, and $4.74 as take-profit levels.