While a handful of cryptocurrencies have become household names, the world has eventually recognized the power of digital coins. There are over 4,000 cryptocurrencies that can be bought, sold, or traded on various exchanges.

The rise of these digital coins may create significant investment opportunities. However, regulatory uncertainty sometimes acts as a hindrance.

It is the main reason why different crypto-famed enthusiasts have expressed the urgent need for clarity. Some even proposed their regulatory recommendations for cryptocurrency.

Acknowledge the facts

In one such context, crypto-focused venture capital firm Andreessen Horowitz has put out its vision for the future of crypto regulation. It released a brief document, titled “10 Principles for World leaders Shaping the Future of Web3”. It aims to ground ongoing international policy debates around the potential of web3. As per the blog, regulators face the challenge of delivering on the extraordinary promise of Web3. While mitigating the real risks that accompany the deployment of new technology.

For context: Web3 is a group of technologies that encompass digital assets, decentralized finance (DeFi), blockchains, smart contracts, tokens, and decentralized autonomous organizations (DAOs).

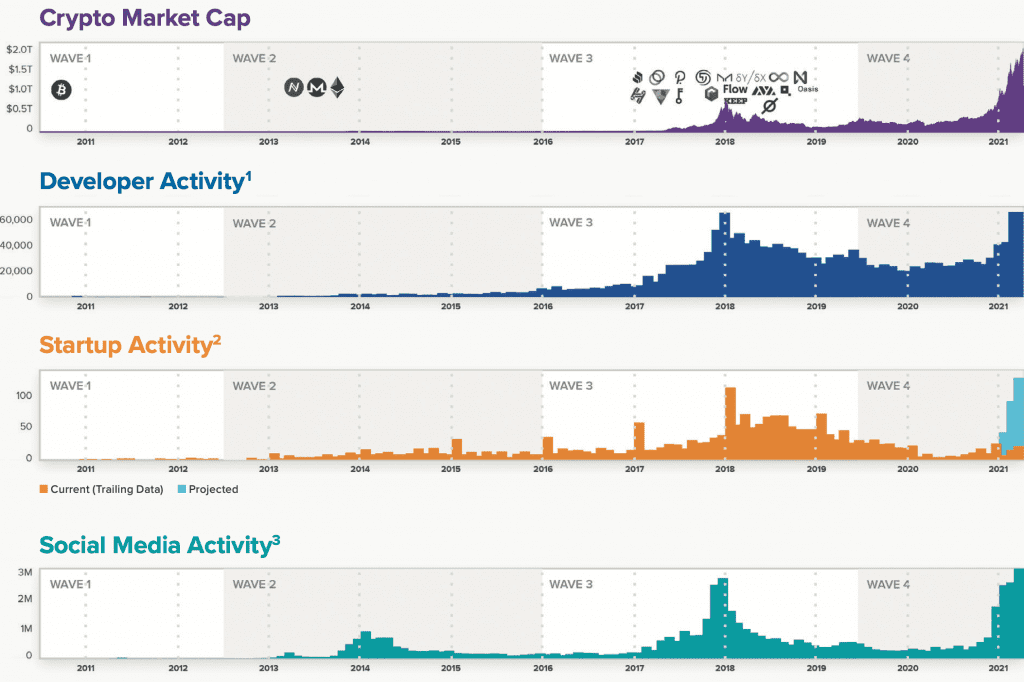

The leading web3 applications, marketplaces, and game studios are geographically dispersed. Many projects are now built by globally decentralized teams operating as DAOs. International developer communities are growing at an unprecedented rate. The plot below focuses on the same.

Source: a16z.com

As seen above, financial technologies (crypto) have been a hit over the years. That said, very little has been done to improve regulations given the absolute value.

“Decentralized financial technologies already handle hundreds of billions in transaction volume every day and provide compelling evidence that there is a pathway for instantaneous, global, 24/7 financial rails,” the report noted.

The report even touched upon Stablecoins. These fiat-pegged cryptocurrencies have been eyed warily by U.S. officials. There’s no denying this, U.S regulators highlighted different risk narratives when dealing with it. Hence, it needs to be “well-regulated” and then put to work improving the financial system.

“Stablecoins are a basic building block on which this financial innovation is occurring.”

In addition to this, a16z encouraged inter-country collaboration on crypto standards, more transparent tax codes, and “targeted” regulatory regimes that recognize the diversity of Web3 technologies. Furthermore,

“Treating all digital assets in the same way is analogous to having a single legal regime to cover stocks, real estate, cars, art, watches, and trading cards.”

Overall, here’s a summary of all the 10 recommendations:

Source: a16z.com

Following these guidelines, regulators are “better equipped to address unanticipated challenges on the path to population-scale adoption.”

Clear regulations/ litigations have been one of the most asked demands with the crypto community. Other crypto exchange platforms such as Coinbase, FTX too shared similar blogs to aid the government.