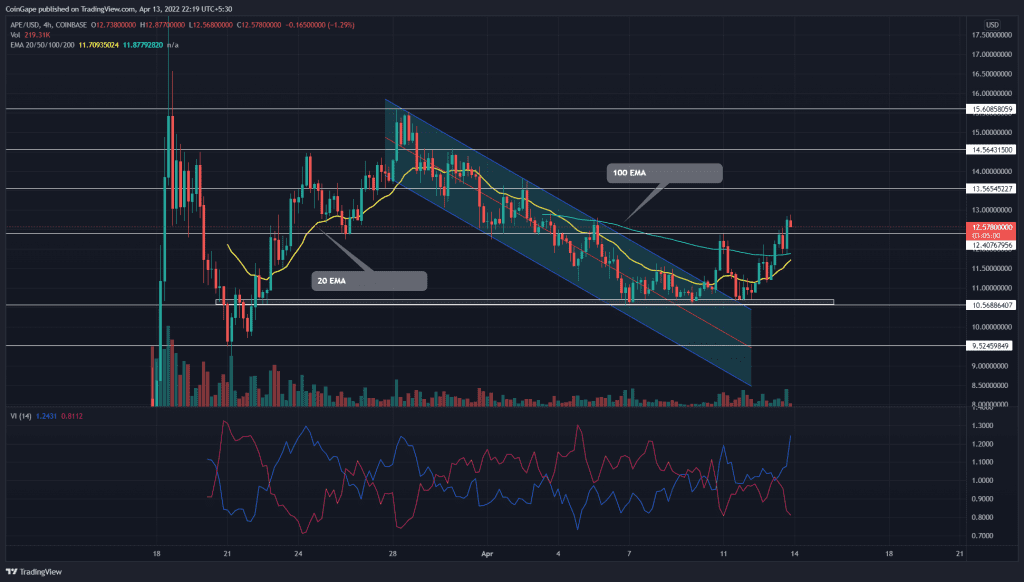

The post-retest rally of falling channel breakout surged the Apecoin(APE) price by 18%. The new bullish rally sliced through $11.5 and $12.6 resistance, indicating the buyers are attempting for another leg higher. The post retest rally would surge APE price by 8% to $13.6

Key points:

- The 20 and 100 SMA are poised for a bullish crossover

- APE buyers could expect the next supply region at $13.6

- The intraday trading volume in Apecoin is $739.4 Million indicating a 20.57% gain.

Source- Tradingview

On April 8th, the APE/USDT pair escaped a two-week correction phase with a bullish breakout from the channel pattern. The breakout rally pivoted from the $12.4 local resistance and plunged to retest the breached resistance at $10.56.

Responding to bullish RSI divergence, the APE price rebounded from the bottom support with a morning star candle pattern. The new recovery breached the previous swing’s high resistance of $12.4, symbolizing an upcoming bullish trend.

If buyers sustain this bullish breakout, the altcoin will rise 8% to the $13.56 resistance. Anyhow, the channel breakout should lead the APE price to the March 28th peak resistance at $15.6.

On a contrary note, if buyers failed to sustain above the $12.4 mark, the altcoin would retest the $10.56 bottom support.

Technical Indicator

EMAs: The rising 20 EMA slope gives a bullish crossover to the 50 EMA and is on the verge of crossing above the 100 EMA as well. These crossovers provide additional confirmation for buyers.

Vortex indicator: the sudden spread between the VI+ and VI- slope reflects aggressive buying from traders.

- Resistance levels: $12.3 and $13.7

- Support levels: $11.5 and $10.5