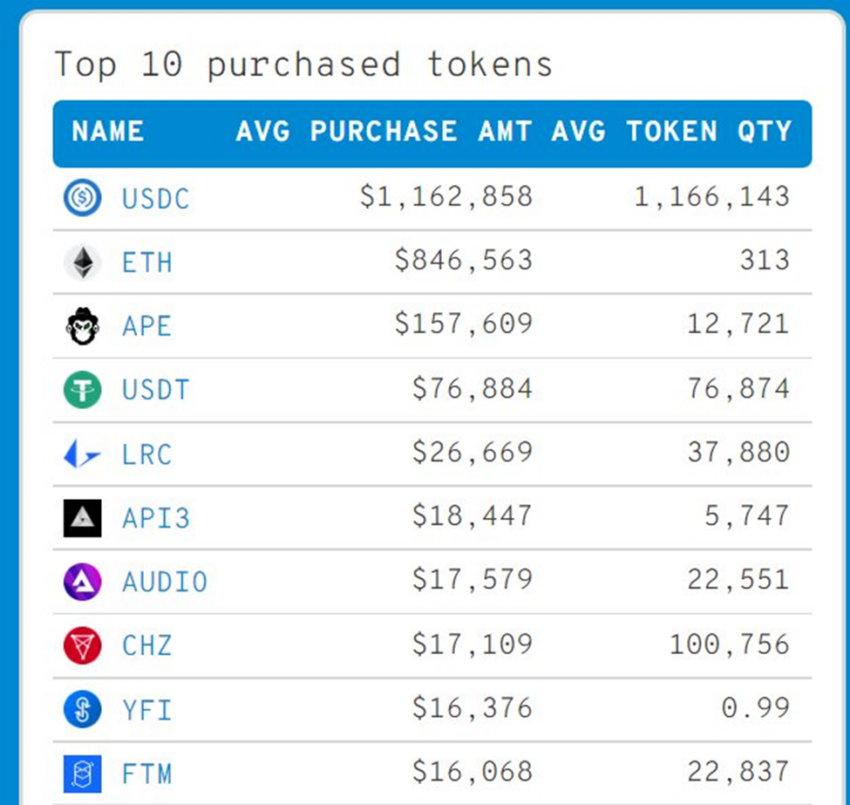

ApeCoin has surpassed Tether (USDT) and Loopring (LRC) as the third most purchased cryptocurrency after Ethereum (ETH) and USDC by the top-100 Ethereum wallet addresses.

APE is the native asset of the ApeCoin ecosystem. APE rose to an all-time high price of $39.40 on March 17, 2022, on the back of FOMO and a recovering crypto market.

APE has seen an average of $2.07 billion in daily trading volume in May buoyed by the launch of the Otherside metaverse. This is a signal of consistent investor interest in the cryptocurrency.

According to Be[In]Crypto research, APE has become the third-most purchased digital asset with an average purchase amount of $157,609 and an average quantity of 12,721 APE.

Aside from APE, other digital assets such as Tether (USDT), Chiliz (CHZ), Fantom (FTM), Yearn Finance (YFI), and Loopring (LRC) are among the most purchased cryptocurrencies by the top-100 wallet addresses.

APE thrives on the ecosystem built around the Bored Ape Yacht Club NFT collection by Yuga Labs. At the time of publishing, BAYC is the third-biggest digital collectible by sales volume.

BAYC’s popularity and ApeCoin’s use as an eligibility requirement in receiving free airdropped land deeds during the Otherside metaverse launch have contributed to the increasing demand for the cryptocurrency.

What’s the latest on ApeCoin?

The communities of the Bored Ape Yacht Club and the Mutant Ape Yacht Club (MAYC) are part of the APE ecosystem. These digital collectibles play an integral role in an airdrop event that will see 150 million APE released to holders of the NFTs.

BAYC holders are eligible to claim up to 10,094 APE while MAYC holders are eligible to claim up to 2,042 APE.

Earners of APE from this event have up to 90 days to claim their coins or the unclaimed coins will be sent to the Fund of the ApeCoin ecosystem. The ApeCoin airdrop began in March and will end on June 15, 2022.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.