While NFT hacks have been observed mainly on the NFT marketplaces in the past, the Bored Ape Yacht Club (BAYC) on 1 April witnessed the same on its Discord. The incident created a panic within the community.

BAYC hack cost a MAYC

Surprisingly, the hacker managed to steal a Mutant Ape Yacht Club (MAYC) NFT. At the time, MAYC was priced at 20 ETH ($69k). The NFT has since left the address. And, reportedly, it was resold for 23.64 ETH ($82k).

While the actual reason behind the hack has not been revealed, the BAYC team simply sent out a precautionary message saying,

“STAY SAFE. Do not mint anything from any Discord right now. A webhook in our Discord was briefly compromised. We caught it immediately but please know: we are not doing any April Fools stealth mints / airdrops etc. Other Discords are also being attacked right now.”

This incident wasn’t the best thing for ApeCoin holders. Since its launch, both the token and network have had a lackluster performance.

Usually, when a development such as “the launch of the native token of the second biggest NFT collection in the world” occurs, the crypto community goes berserk. They buy hundreds of thousands of dollars worth of monkeys and pixels.

Unfortunately, that was not the case with APE.

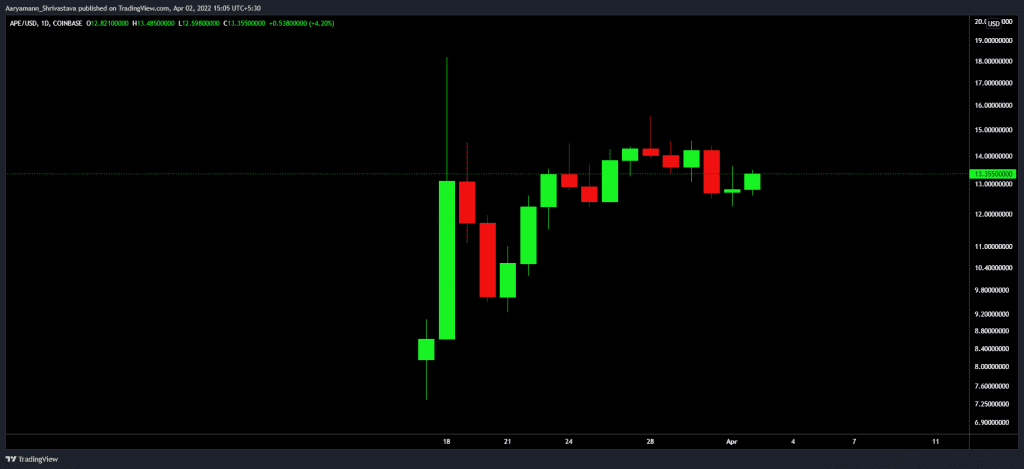

The altcoin’s price action has seen no spectacular changes over the last couple of days. Any rise since its launch has been countered with a drop. Consequently, at the moment, the NFT token is trading at $13.12- slightly above its inception level.

ApeCoin price action | Source: TradingView – AMBCrypto

Secondly, on-chain metrics show that in the two weeks following ApeCoin’s launch, the altcoin adoption rate has plunged significantly.

Notably, the lack of network growth can keep APE from noting high figures of unique addresses.

ApeCoin network growth | Source: Santiment – AMBCrypto

Furthermore, since the price levels have remained unchanged post 17 March, the current supply held by investors is neither in profit nor in a loss. Although it was in profit two days ago, the 10.62% drop reverted it.

ApeCoin supply is neither in profit nor in loss | Source: Santiment – AMBCrypto

But the most surprising factor of all is the descent of its social presence. As mentioned above, this is the second biggest NFT collection with NFTs with holders such as Justin Bieber. However, its domination over social channels, which was at about 8% on the day of its launch, is currently at 1.47%.

ApeCoin social presence | Source: Santiment – AMBCrypto

For low social dominance, transaction volume does not look to be the primary reason. In fact, it seems that ApeCoin’s appeal to the investors is pretty low at the moment which could be acting as a hindrance to the token’s growth. Undeniably, it is difficult to assess if APE could get its hype back.