ApeCoin was among the hardest hit cryptocurrencies in May’s market crash and this led to a sharp decline in its market value. The asset is supported by one of the most successful NFT projects of all time—the Bored Ape Yacht Club.

ApeCoin remains a top 50 digital asset by market capitalization in June 2022. APE closed the fifth month of the year with a market value of approximately $1.97 billion, according to Be[In]Crypto research.

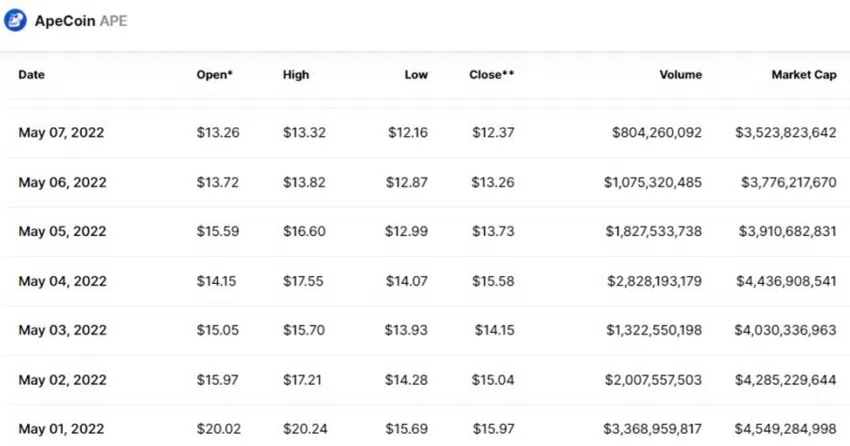

While this number seems high due to the plunge in the value of other digital currencies, this figure was a 56% dip from its market value on May 1. On that day, APE saw an impressive trading volume of $3.37 billion which corresponded to a market capitalization in the region of $4.55 billion.

Why the sinking market capitalization?

A sell-off by holders spiked on the first day of May and intensified in the week of May 9 to 13 and played a large role in the decreasing market capitalization of ApeCoin.

Many analysts have credited inflation, the economic uncertainties of the Russian/Ukraine crisis, and the Federal Reserve’s quest to control inflation by raising interest rates as the factors for the downturn in APEs valuation.

On May 1, the number of large transactions involving APE reached a peak of 2,580 at a price of $15.97.

This corresponded with a large transaction volume of 94.36 million APE at the same price.

The 94.36 million APE multiplied by the price of $15.97 equaled a total volume of around $1.51 billion.

On May 1, APE opened at $20.02, reached an intraday high of $20.04, shed 21% of this day’s high to an intraday low of $15.69, and closed the day at $15.97. Due to losing more than one-fifth of its price on the opening day of the month, APE could not recover and plunged further to create higher lows throughout May.

APE price reaction

APE opened on May 1, at $20.02, reached a monthly high of $20.04 on the same day, tested a monthly low of $5.25 on May 11, and closed the month at a trading price of $6.76.

Overall, this equates to a 66% drop in the opening and closing price of APE in May.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.