The creators of one of the most famous NFT series, Bored Ape Yacht Club, have recently launched their own token and DAO. The utility token will be used to empower the DAO and make in-game purchases and other activities. Moreover, Time Magazine recently announced that they would be accepting subscription payments in the form of Apecoin.

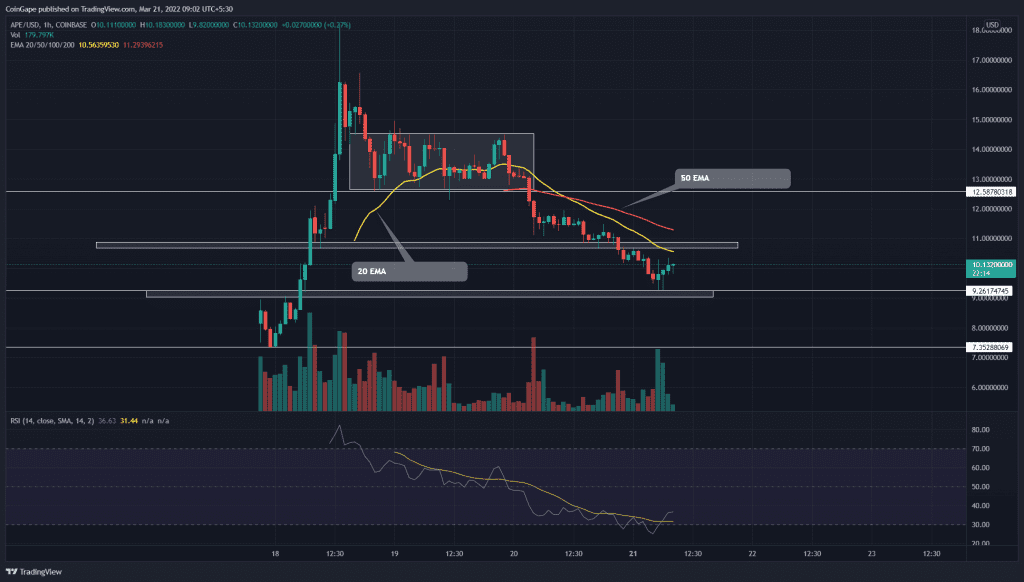

Let us study the technical chart of the APE/USD pair to understand price behavior.

Source- Tradingview

Past Performance

The parabolic rally in the APE/USDT pair has surged the price to an $18 psychological level on March 18th. The long-wick rejection attached to those candles suggested the sellers are aggressively defending this level.

The resulting bearish reversal tumbled altcoin by 28.27%, bringing it to the immediate support of $12.9. On March 19th, the altcoin resonated between the $14.58 and $12.9 level, creating a narrow range.

Technical analysis

The minor consolidation ended in favor of the bear as the price breached the $12.9 bottom support. The gradual selling continued the correction rally and dumped it by another 25% to the $9.2 mark.

However, the long-tail rejection at this support suggested the investors are interested in this dip. A bullish breakout from the $10.8 resistance would provide a recovery opportunity for traders.

Contrary to the bullish thesis, if sellers violate the $9.2 bottom support as well, the short-sellers can expect the next target to $7.35.

Indicators

The declining 20-and-50 EMA put the sellers at a greater advantage. These EMAs would act as a valid resistance level, assisting the sellers in defending the $10.6 resistance.

However, the RSI indicator slope rebounded from the oversold region and has breached the 14-SMA dynamic resistance.

- Resistance level: $10.8 and $12.58

- Support levels: $7.35 and $9.2