Ever had a carefully curated food item that despite its amazing smell and texture lacks a key ingredient? And how adding that one key element just elevates the entire dish. Well, the leader in the Layer-2 space, Arbitrum, faces the same ordeal.

Arbitrum provided the fastest recorded transactional throughputs and the shortest time to finality as compared to other L2s. But still, it lacked a key element.

Here’s AMBCrypto’s Price Prediction for GMX for 2023-24

Finding the missing piece

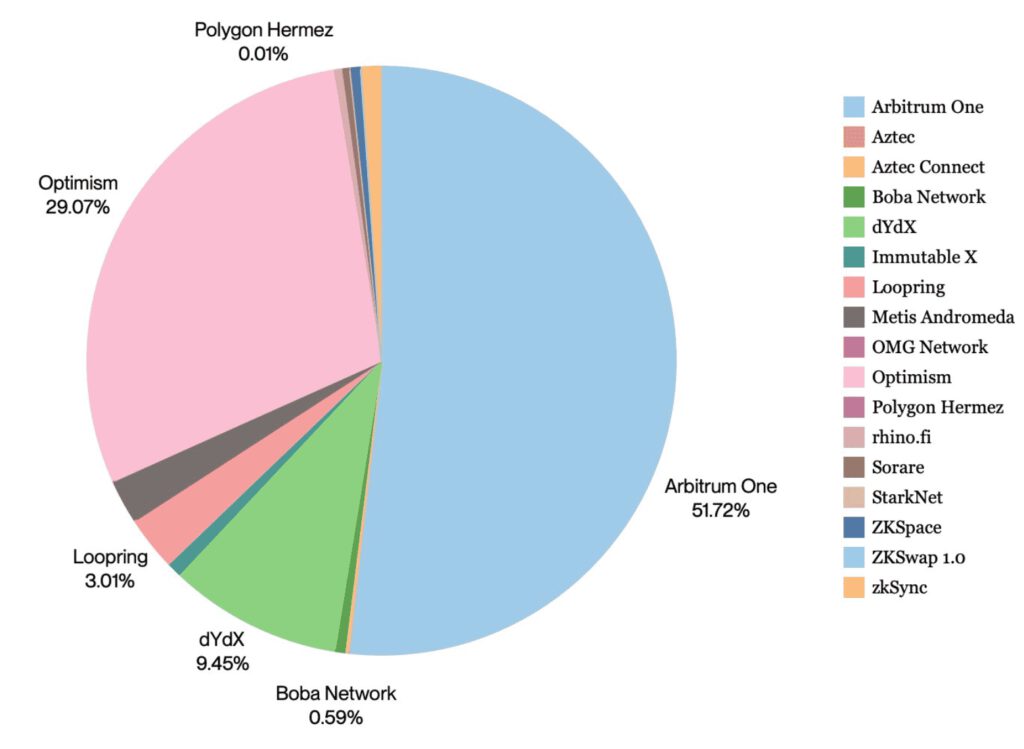

Arbitrum, the Layer-2 scaling platform, had some successful campaigns that led to strong user growth and retention. At press time, the platform had a 51.72% market share and 80+ dApps as seen in the graphical representation below.

Herein the launch of Arbitrum Nitro enabled DEX volume to surge as a result of near-zero gas fees, with Q3 witnessing more than $2 billion in cumulative trading volume across three major DEXes.

Moving on to the TVL front, Arbitrum held over $2.40 billion in total value locked (TVL), which did create buzz when compared to other fellow travelers.

Having said that, Arbitrum’s TVL for Q3 was roughly flat as per analysis from ‘The Tie‘, a digital asset data interpretation platform.

As per the analytics platform,

“Without a token, tracking Arbitrum is focused more on analyzing the user growth and development taking place in the ecosystem. Quarter-over-quarter daily transactions are up 62.7% despite an unfavorable macro environment.”

However, Arbitrum didn’t launch a token that could be used to incentivize TVL natively. Indeed, aiding the network to sustain the aforementioned growth. Not just that but the network even recorded some impressive milestones with two key developments: Nitro and Odyssey.

The Odyssey campaign caused a jump in block count, resulting in high block time. Post-Nitro, we’ve seen high block counts handled easily, suggesting positive signs for the influx activity that is certain from the resumption. pic.twitter.com/Kje8S395t3

— The Tie (@TheTieIO) October 7, 2022

Overall, L2 applications have attracted real usage and attention, namely GMX on Arbitrum. Especially, now with all the speculations around dropping Arbitrum’s own token– this “organic” growth could see new heights.

Can it deliver?

Needless to say, expectations from the network were high. Now, the question remains, could it fulfill investors’ expectations?

Well, only time will narrate this part of the picture but for now, crypto enthusiasts did maintain a bullish scenario around the platform as investments did see some results. For instance, Uniswap Labs highlighted the following.

It’s been one year of Uniswap v3 on @arbitrum and we just hit an ATH of 78.7% market share 🥳 pic.twitter.com/2mXw8l1jbs

— Uniswap Labs 🦄 (@Uniswap) October 4, 2022

Meanwhile, Ethereum liquid staking protocol Lido announced the expansion of its staking token stETH to the Ethereum layer 2 network Arbitrum Bridge.